GOLD experienced a bullish run in March, creating a new all-time high following a period of consolidation to start the year. The metal extended its bullish run after the Federal Open Market Committee meeting, where the US Federal Reserve affirmed its plan for 75 basis points of cuts to the Fed funds rate this year, which was in line with prior messaging.

The confirmation of the Fed’s December rate projections resulted in a dovish repricing of the US dollar and shorter-dated yields such as the two-year Treasury yield. This dovish stance provided gold with the ammunition to scale new heights given the inverse cross-asset relationships.

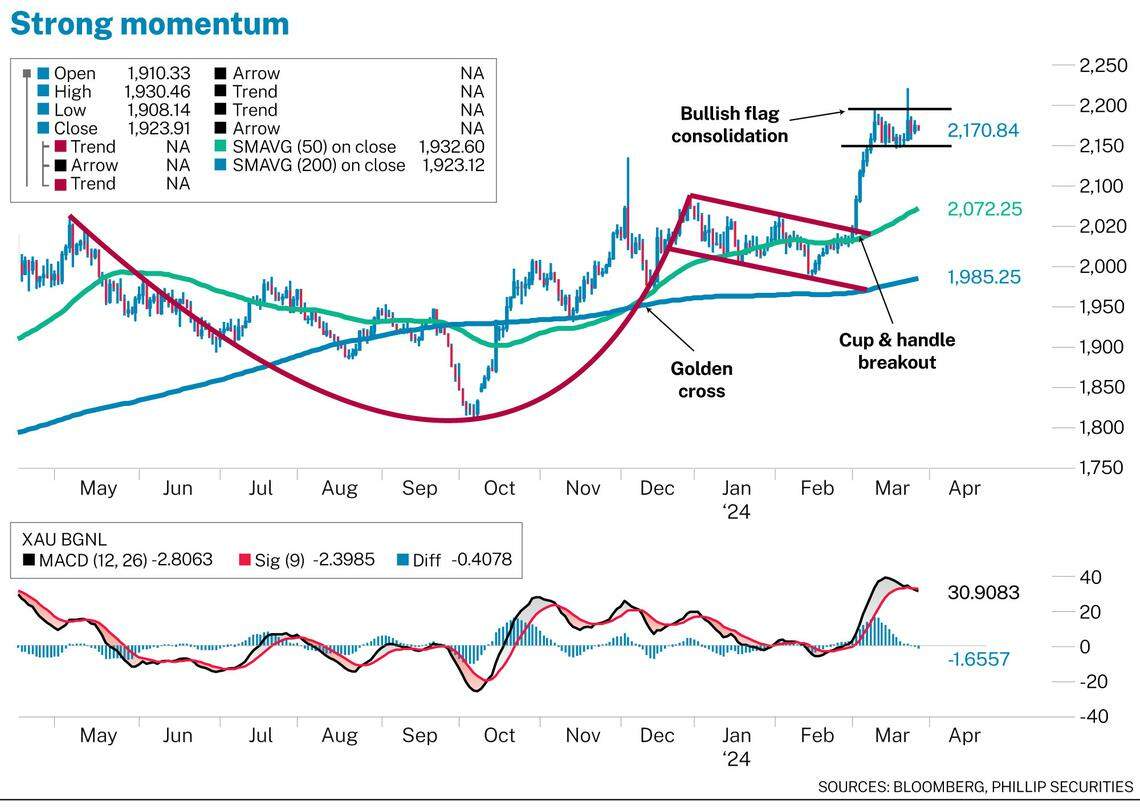

From a technical perspective, investors will have reasons to cheer, with gold expected to scale new all-time highs going forward. Firstly, gold broke out of a bullish cup-and-handle formation in early March, which is considered a bullish signal for extending an uptrend.

Secondly, the breakout occurred following a golden cross formation in December last year. The golden cross is a technical pattern where the shorter-term 50-day moving average rises above a longer-term 200-day moving average, which is indicative of a strong bull market.

Thirdly, gold is currently trading within a bullish-flag consolidation between US$2,150 per ounce to US$2,200 per ounce, which suggests a bullish continuation pattern. The strong momentum in bullion is also reflected in the Moving Average Convergence Divergence technical indicator, as it reached a new high in over two years.

Given the aforementioned reasons, gold is anticipated to continue its bullish trend, potentially reaching a new all-time high target of US$2,250 per ounce. This projection is calculated using the height of the cup-and-handle formation, which amounts to US$200 per ounce, projected onto the breakout level at US$2,050 per ounce. Additionally, this level is confluent with the target of the current bullish flag consolidation, which extends the range of US$50 per ounce onto the breakout level at US$2,200 per ounce.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

The writer is research analyst at Phillip Securities Research