Spooked by a flurry of hotter-than-expected U.S. economic and inflation data last month, investors are reviving trading strategies that bet on a higher peak in interest rates.

The recalibration in inflation expectations has led some investors to bet on a policy rate of 6% or even higher. Risk assets like stocks and corporate bonds that benefited from a months-long disinflationary narrative until the end of January have lost momentum, with traders now seeking shelter in safer assets like Treasuries or cash.

“The last month was a bit of a wake-up call,” said Doug Fincher, a portfolio manager at Ionic Capital Management and a co-portfolio manager of an inflation protection exchange traded fund. “People still under appreciate it, but we’re definitely seeing renewed interest in inflation-type products,” he said.

Bets on the Federal Reserve more aggressively hiking rates have gained more traction in money markets. The probability that the Fed may increase rates to as high as 6% in September, which is when Fed funds futures traders see rates peaking, stood at over 13% on Monday, up from about 8% a week earlier, CME Group data showed.

Alfonso Peccatiello, chief executive of The Macro Compass, a global macro investment strategy firm, said anecdotal evidence from clients in the hedge fund industry showed “large interest” in trading structures that bet on the Fed’s policy rate hitting 6% or higher by December, and on interest rates still above 5% by June next year.

These trades are often implemented via options, in particular by betting on the direction of the secured overnight financing rate (SOFR) – with a ‘yes or no’ wager on a level above 6% the main factor driving the trade’s profitability, Peccatiello said.

Trading platform Tradeweb said it saw average daily volume in inflation swaps – derivatives used to hedge inflation risk – increase by 23% month-on-month in February.

With higher inflation expectations lifting short-term bond yields higher than those at the longer end, some investors are wary of committing to debt maturities at the long end of the bond market yield curve.

Anthony Woodside, head of U.S. fixed income strategy at LGIM America, said underweighting corporate credit in favor of risk-free assets such as Treasuries was one way to play the higher-for-longer theme over the next few months.

“While all-in yields look attractive, corporate credit spreads look too tight given that we are likely headed for a downturn amidst restrictive monetary policy,” he said, referring to expectations the tightening could eventually trigger a sharp economic slowdown.

Outside of fixed income, adding exposure to commodities could be a way to take advantage of the demand behind the current impulse in global economies.

“With China being a large source of demand we see potential for upward pressure on oil prices in the coming quarters. Copper can benefit for similar reasons,” Woodside said.

FED ANTICIPATION

Investors trying to predict the Fed’s moves will be focused on Fed Chair Jerome Powell’s testimony to Congress on Tuesday, which comes ahead of the Fed’s next rate-setting meeting on March 21-22.

Traders largely expect the central bank to raise rates by 25 basis points, although the probability of a 50-basis-point hike stood at about 30% on Monday, according to CME Group data.

The U.S. Federal Reserve last year lifted borrowing costs at the fastest pace in 40 years, but scaled back to a quarter-percentage-point rate increase last month.

In the market, pricing has moved in expectation of more aggressive rate hikes as the latest economic data reflects a tight job market and inflation remaining high, reviving fears the Fed may need to resort once again to the same chunky interest rate hikes that hammered stocks and bonds last year.

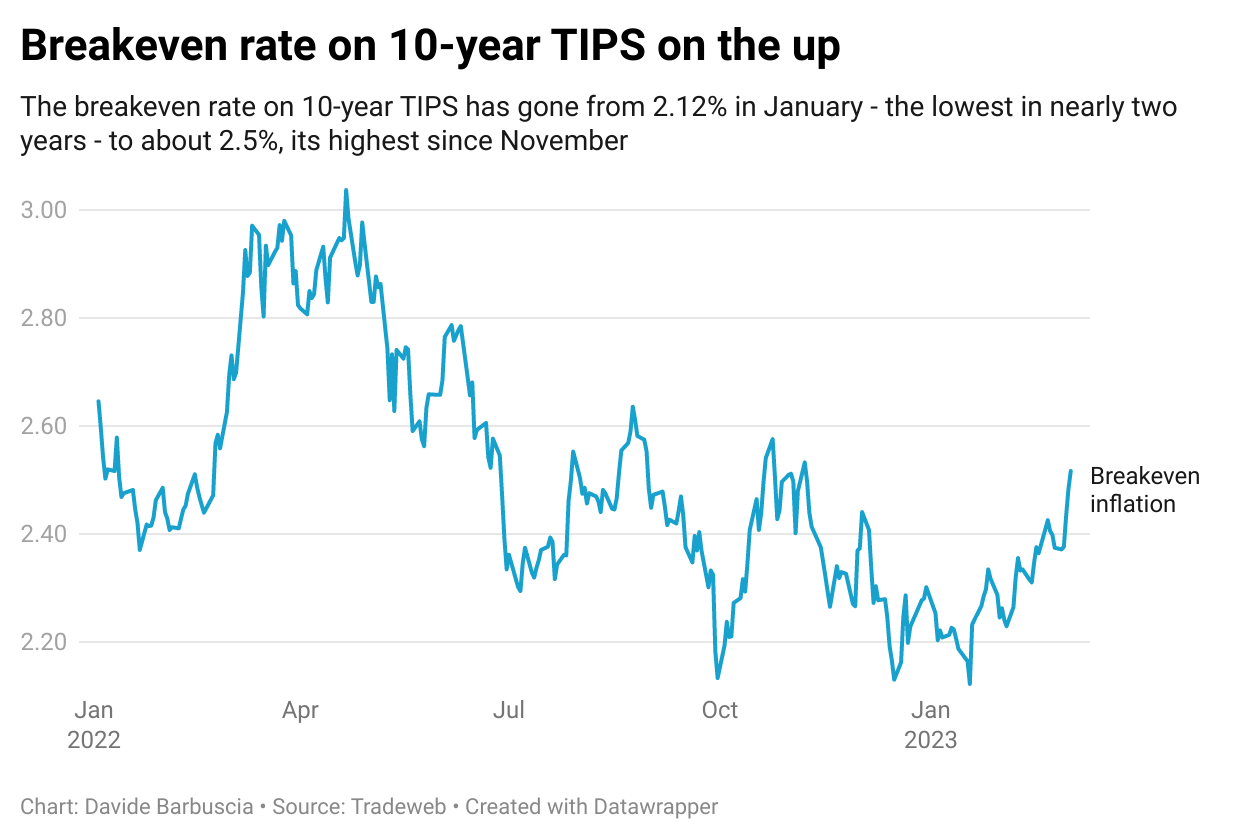

A proxy of inflation expectations such as the breakeven rate on 10-year U.S. Treasury Inflation-Protected Securities (TIPS) has gone from 2.12% in January – the lowest in nearly two years – to about 2.5%, its highest since November.

Graphic: Breakeven rate

U.S. government bond yields spiked in February with the benchmark 10-year yield back at over 4% last week, its highest since November. Two-year yields, which more closely reflect monetary policy expectations, have gained about 70 basis points since the beginning of last month, reaching levels not seen since 2007 before the financial crisis.

“The Fed could be forced to go 50 basis points at their next Federal Open Market Committee meeting if we get another strong employment report,” said Torsten Slok, chief economist at Apollo Global Management, who sees a terminal rate possibly above 6%.

“The momentum in the economy is so strong that we may have to get into 2024 before the Fed funds rate peaks.”