CHINA’S central bank governor said on Friday (Oct 18) the reserve requirement ratio for commercial lenders could be cut further by 25 to 50 basis points (bps) by the year-end depending on liquidity conditions, keeping the door open to more policy easing steps.

The benchmark seven-day reverse repurchase rate has been lowered by 20 bps and the medium-term lending facility rate has been reduced by 30 basis points, People’s Bank of China (PBOC) governor Pan Gongsheng told a financial forum in Beijing.

On Oct 21, the Loan Prime Rate will decrease by 20 to 25 bps, the official Xinhua news agency quoted Pan as saying.

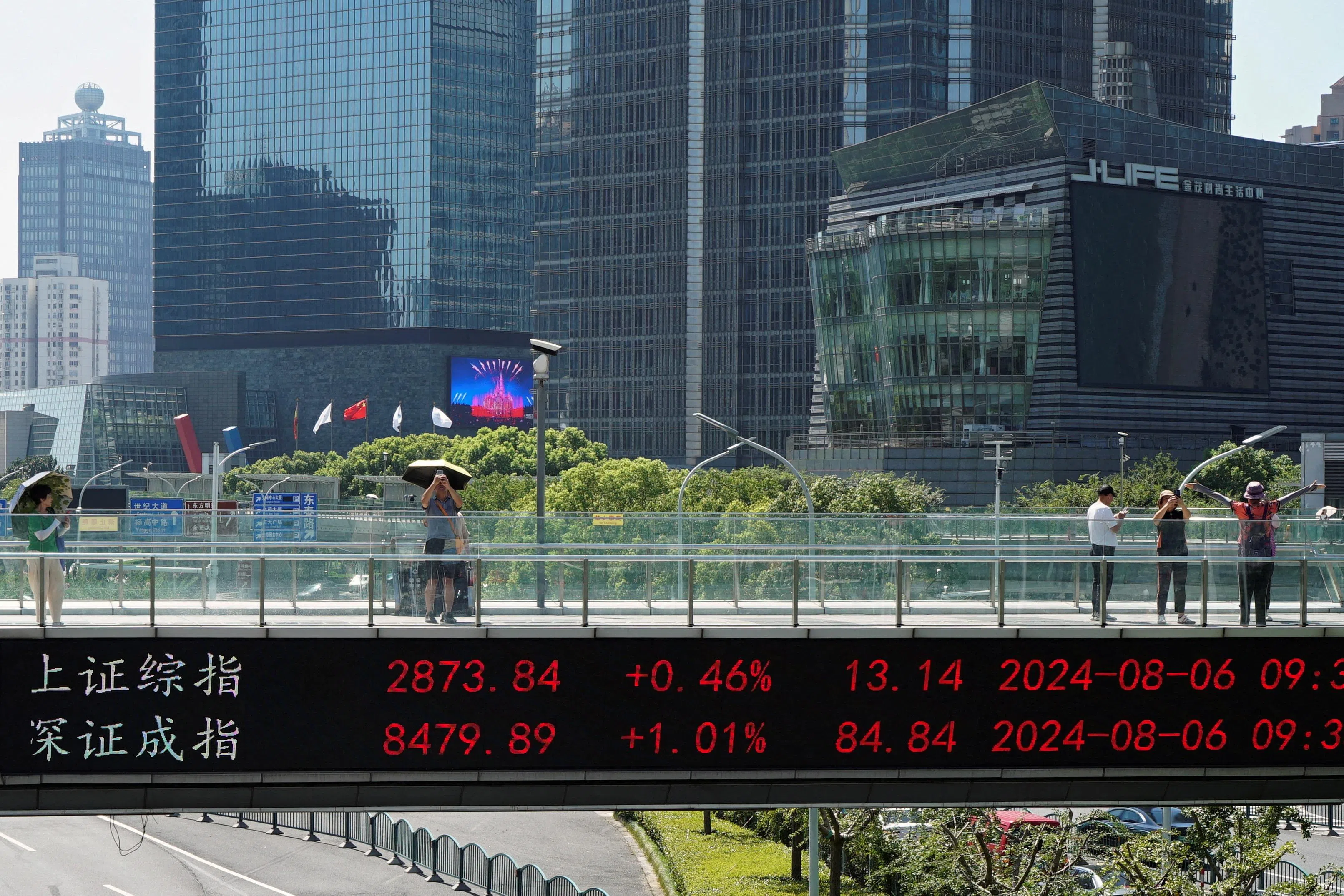

Pan had previously flagged more potential stimulus steps to support the faltering economy after announcing in late September measures to stabilise the housing sector and rekindle capital market confidence.

At the financial forum on Friday, Pan also warned against any illegal fund flows into the stock market.

The PBOC introduced two new tools in September to support markets.

These were a swap programme giving funds, insurers and brokers easier access to funding for stock buys, and relatively cheap PBOC loans to help banks finance listed companies’ share purchases and buybacks.

Pan said the two measures were based entirely on market-oriented principles, and the swap facility was not a form of direct financial support from the central bank.

The bank’s provisions regarding stock buybacks and purchases have specific directional aims, and the fundamental bottom line was that loan funds must not unlawfully enter the stock market, Pan added. REUTERS