Reuters

The U.S. Senate will vote later on Wednesday on a Republican measure intended to prevent retirement plans from considering environmental, social and corporate governance, or ESG, issues in their investment decisions.

The resolution, which passed the House of Representatives on Tuesday, would block President Joe Biden’s Labor Department from enforcing a rule that also makes it easier for plan managers to look to ESG factors when exercising shareholder rights, such as through proxy voting.

Republicans need only a simple majority in the chamber, which Democrats control 51-49, to send the measure on to Biden, who is expected to veto it. Approval could open the door to other Republican efforts to overturn Biden administration regulations.

The political battle marks the latest clash in a Republican war against what they decry as “woke” business practices that is likely to intensify as the 2024 presidential campaign gets under way.

Republicans claim the rule, which covers plans that collectively invest $12 trillion on behalf of 150 million Americans, would politicize investing by allowing plan managers to pursue liberal causes, which they say would hurt performance.

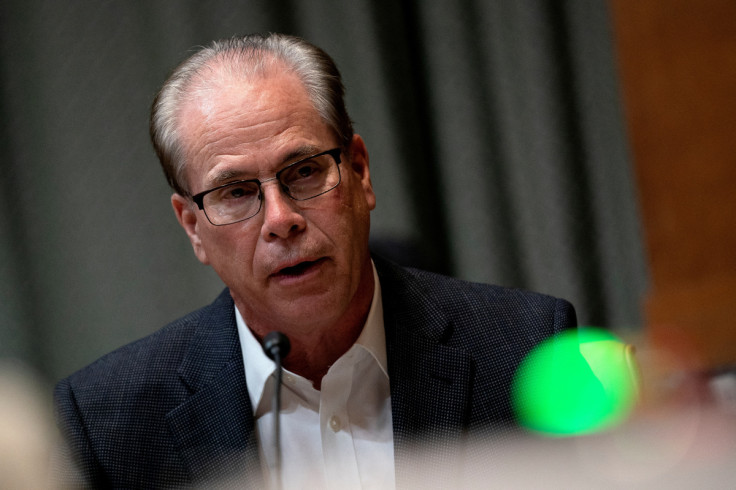

“The last thing we should do is encourage fiduciaries to make decisions with a lower rate of return for purely ideological reasons,” said Republican Senator Mike Braun, who introduced the measure.

Democratic Senate Leader accused Republicans of interfering with private investing decisions, saying on the Senate floor that they are “forcing their own views down the throats of every company and every investor.”

The regulation prohibits plan managers from subordinating financial interests to other objectives, according to a Harvard Law School analysis, which found it makes largely cosmetic changes to a more restrictive rule set in place under former President Donald Trump.

The Labor Department said the Trump-era rule failed to account for the positive impact that ESG investing can have on long-term returns. Industry has been split on the Biden rule, with fossil-fuel companies opposed and other businesses voicing support.

In 2022, ESG funds were hit by fallout from the Ukraine war, tumbling financial markets and U.S. political backlash against the industry. As a result, those funds lagged non-ESG funds for the first time in five years after fossil fuel shares – which they typically shun – soared.

Republicans won the support of Democratic Senator Joe Manchin to force a vote by invoking the Congressional Review Act, a legislative tool that allows them to bypass the customary 60-vote threshold for passing most legislation.

Even with Democratic Senator John Fetterman and Republican Senator Mike Crapo absent for health reasons, Republicans would need an additional vote to pass the measure on a simple majority.

On Tuesday, the House approved the same resolution in a largely party-line vote.

Reuters

Reuters