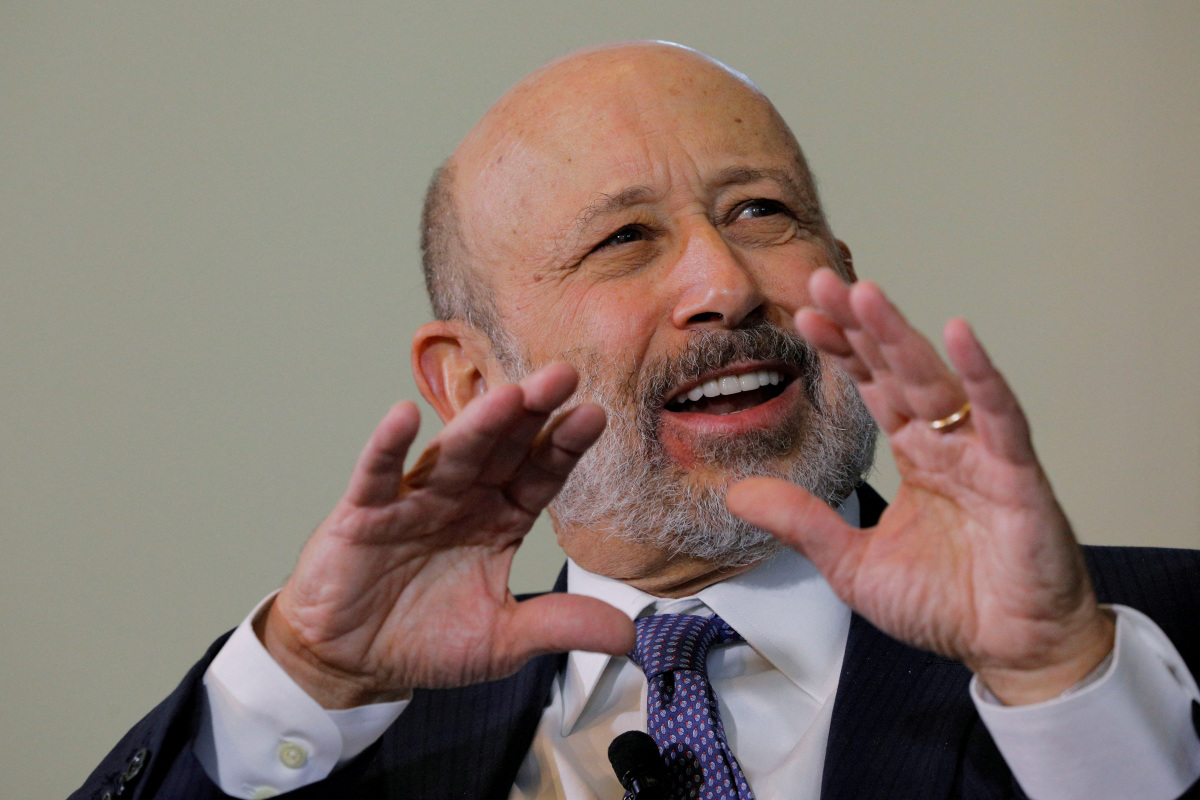

Reuters

Former Goldman Sachs CEO Lloyd Blankfein said on Sunday the banking crisis in the United States was going to expedite overall credit tightening and slow the U.S. economy.

“It is a certainty that this will – that this situation will cause – will act in a way that’s similar to a rate rise in some ways. Banks will have to, you know, because of the tension, because of the pressure and uncertainties, banks will husband their equity,” Blankfein told CNN in an interview on Sunday.

“They’ll do less lending on the deposits they have. And so already there’s going to be less credit. Less credit means less growth. So, some of the mission of the Fed in trying to slow the economy will be done here,” the former Goldman Sachs CEO added.

Financial stocks lost billions of dollars in value since Silicon Valley Bank and Signature Bank collapsed earlier in March. U.S. President Joe Biden said on Friday the banking crisis has calmed down. He also told Americans that their deposits are safe.

Gary Cohn, who served as economic adviser to former President Donald Trump and is also a former Goldman Sachs president, told CBS News that Federal Reserve Chair Jerome Powell was in a “tough spot.”

Both Cohn and Blankfein supported the prediction that the Fed will raise interest rates by 0.25% in the coming week but added that the central bank may need to pause and reassess thereafter to give itself room going forward.

“The market is projecting better than a 70% chance that the Fed raises 25 basis points. I personally – I personally think it would be okay to stop here,” Blankfein told CNN.

The economics team at their former bank were among the first to predict the banking turmoil would lead the Fed to forego an interest rate increase at this week’s meeting on Tuesday and Wednesday.

Nevertheless, futures markets as of Friday saw a better than even probability that Fed would proceed with a 25 basis point increase, a view echoed by a poll of economists from Reuters on Friday.

Investors are currently pricing a 60% probability that the Fed will raise rates by 25 basis points on Wednesday, with the remainder betting on no change. Some industry executives said the central bank should prioritize financial stability now.

“I think (Fed Chair Powell) will leave himself a lot of room in forward meetings to do whatever they need to do, which may be pause, maybe cut or maybe increase depending on how inflation is going in the United States,” Cohn said on Sunday.