Reuters

U.S. existing home sales rebounded more than expected in February as the first year-on-year decrease in prices in 11 years pulled buyers back into the market, further evidence that the housing market was stabilizing at low levels.

The jump in sales of previously owned homes, which was reported by the National Association of Realtors on Tuesday, was the largest in more than 2-1/2 years and ended 12 straight monthly declines in sales, the longest such stretch since 1999.

The housing market has been the biggest casualty of the aggressive interest rate hikes delivered by the Federal Reserve in its battle to tame high inflation. The surge in sales added to data on housing starts and homebuilder confidence in suggesting that the housing market was probably finding a floor.

“The data suggest that there is a bid underneath the market that may limit the decline in home prices unless mortgage rates rise sharply again, and encourage our belief that the eventual drop in home values will only be a moderate one,” said Conrad DeQuadros, senior economic advisor at Brean Capital in New York.

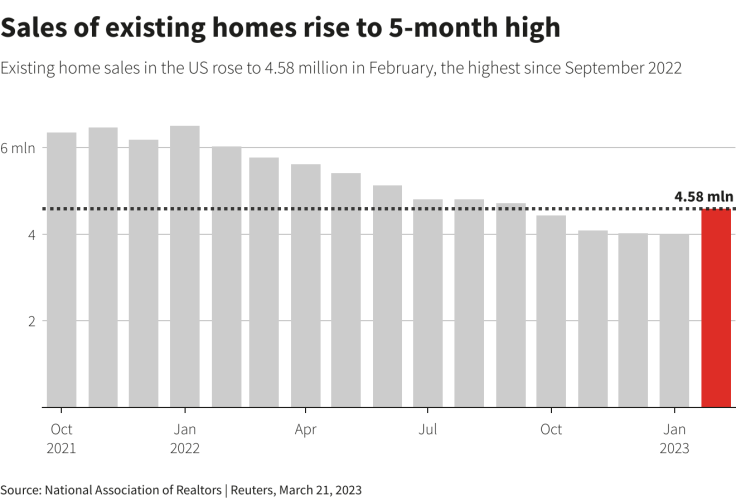

Existing home sales surged 14.5% to a seasonally adjusted annual rate of 4.58 million units last month. Sales increased in all four regions, with the Midwest, West and the densely populated South posting double-digit growth.

Economists polled by Reuters had forecast home sales would rebound 5.0% to a rate of 4.20 million units. Home resales, which account for a big chunk of U.S. housing sales, fell 22.6% on a year-on-year basis in February.

(Graphic: Sales of existing homes rise to 5-month high –

)

Residential investment has contracted for seven straight quarters, the longest such streak since the collapse of the housing bubble triggered by the 2007-2009 Great Recession.

The worst is likely over. A survey last week showed the National Association of Home Builders/Wells Fargo Housing Market Index increased for a third straight month in March, though homebuilder sentiment remains depressed. Single-family housing starts and building permits rebounded in February.

Mortgage rates, which had resumed their upward trend, are falling again in tandem with a sharp decline in U.S. Treasury yields following the recent collapse of two U.S. regional banks that sparked fears of contagion in the banking sector.

But the outlook for the housing market remains unclear. Despite financial market instability, the Fed is expected to raise interest rates by another quarter of a percentage point on Wednesday, according to CME Group’s FedWatch tool.

U.S. stocks were trading higher. The dollar fell against a basket of currencies. U.S. Treasury prices fell.

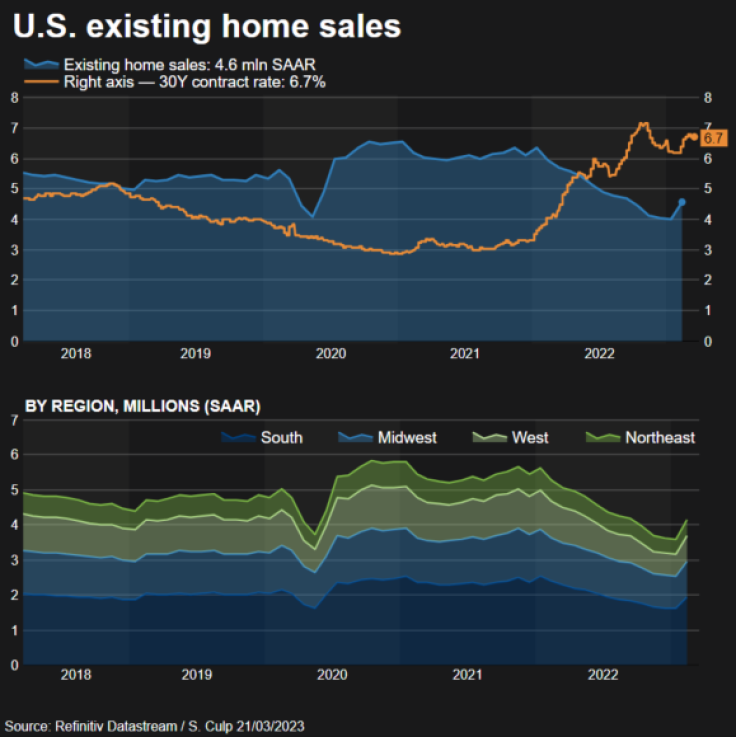

(Graphic: U.S. existing home sales –

)

SUPPLY STILL TIGHT

The median existing house price fell 0.2% from a year earlier to $363,000 in February. That was the first annual price decline since February 2012. Prices dropped on a year-on-year basis in the Northeast and West, the most expensive housing regions. They continued to rise in the Midwest and South, which are generally considered more affordable.

The South experienced an influx of people during the COVID-19 pandemic as companies gave workers the flexibility to work from anywhere in the country.

“We’re seeing stronger sales gains in areas where home prices are decreasing and the local economies are adding jobs,” NAR Chief Economist Lawrence Yun said.

There were 980,000 previously owned homes on the market last month, unchanged from January and an increase of 15.3% from a year ago. At February’s sales pace, it would take 2.6 months to exhaust the current inventory of existing homes, up from 1.7 months a year ago. A four-to-seven-month supply is viewed as a healthy balance between supply and demand.

Properties typically remained on the market for 34 days last month, up from 33 days in January. Fifty-seven percent of homes sold in February were on the market for less than a month.

First-time buyers accounted for 27% of sales, down from 29% a year ago. All-cash sales made up 28% of transactions compared to 25% a year ago. Individual investors or second-home buyers, purchased 18% of homes, down from 19% last February.

Distressed sales, foreclosures and short sales represented only 2% of sales, little changed from a year ago.