First the record wager on higher U.S. interest rates, now the record wipe out.

Commodity Futures Trading Commission (CFTC) data released on Tuesday shows just how badly hedge funds and speculators were wrong-footed by the violent reversal in near-term interest rate expectations triggered by the U.S. and Swiss banking crises.

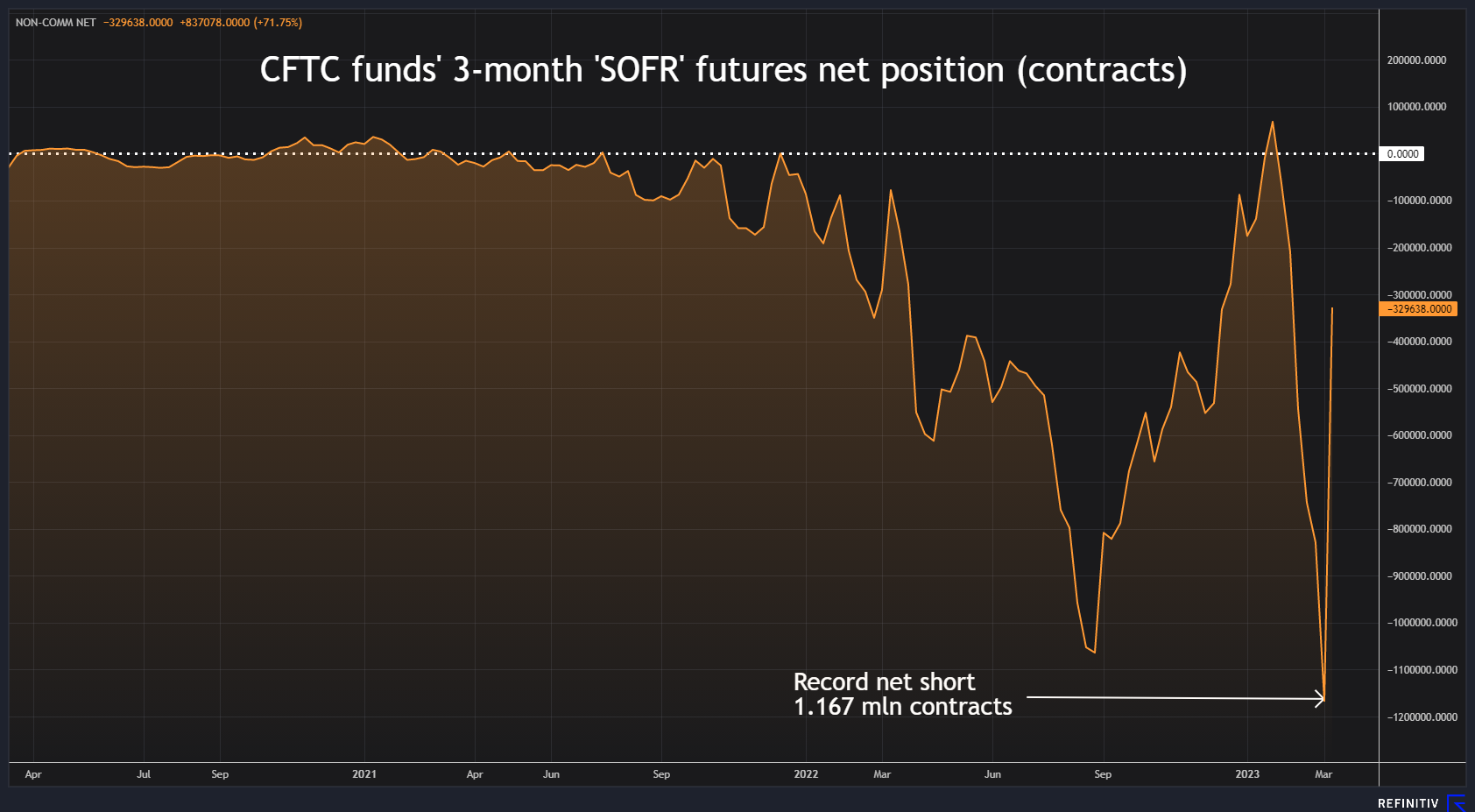

Their record net short position in three-month Secured Overnight Financing Rate (SOFR) futures of 1.17 million contracts was slashed to 329,638 contracts in the week through March 14.

That meant around 80% of funds’ collective bet that the Fed will continue raising rates towards the 6% zone was wiped out in a week, easily the largest weekly position reversal on record.

CFTC funds net position in SOFR futures,

CFTC funds position in SOFR futures – weekly change,

Expectations of a 6% fed funds rate have long faded. The Federal Reserve on Wednesday raised its policy rate by 25 basis points to a 4.75-5.00% range, a move many are viewing as a ‘dovish hike.’ After the decision and Chair Jerome Powell’s press conference, implied SOFR rates across the 2023 curve fell as much as 20 bps, and Bank of America economists lowered their terminal rate outlook by a quarter point.

CFTC positioning data is now up to date, after a cyber attack on the derivatives platform of ION Group delayed trading firms’ reporting earlier this year.

A short position is essentially a wager that an asset’s price will fall, and a long position is a bet it will rise. In bonds and interest rates, yields and implied rates fall when prices rise, and move up when prices fall.

Hedge funds take positions in short-dated U.S. rates and bonds futures for hedging purposes and relative value trades, so the CFTC data is not reflective of purely directional bets. But it is a pretty good guide.

Trend-following and macro funds, and Commodity Trading Advisors have been slammed by the sudden rates reversal, with some suffering losses well into the double digits, according to banks, traders and media reports over the last couple of weeks.

It is difficult to nail down hard numbers, but these losses will almost certainly be running into several billions of dollars.

IN THROUGH THE OUT DOOR

Hedge fund industry data provider HFR’s Macro/CTA index was down 3.60% in March and its Macro Systematic Diversified CTA index was down 7.39%, both for the month through March 20.

The latest CFTC figures also revealed how the recent surge in volatility has put speculative accounts trading three-month SOFR futures out of the market. Or out of business.

Number of CFTC funds trading SOFR futures,

The total number of traders in the week ending March 7 was 676, and in the following week that fell by 19. That doesn’t sound like a big change, but it represents 3% of all players in the space and is the biggest week-on-week fall to date.

It would not be a huge surprise if more were to follow, given the severity of the whiplash in rates markets.

Implied 2023 rates peaked around 5.70% on March 8 – coinciding with CFTC funds’ record short SOFR position – before troubles at Silicon Valley Bank and Signature Bank sowed the seeds of what snowballed into a global banking crisis.

Implied rates then plunged as much as 200 basis points as traders drastically redrew their Fed outlook. The two-year Treasury yield posted its biggest fall since Black Monday in 1987 and U.S. bond market volatility surged the most since 2008.

(The opinions expressed here are those of the author, a columnist for Reuters.)

(By Jamie McGeever; Editing by Andrea Ricci)