Reuters

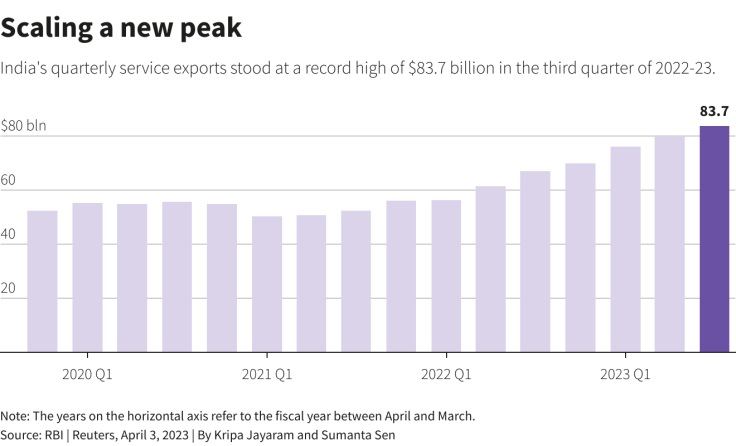

A surge in India’s services exports, which hit a record high in the October-December quarter, is expected to shield the economy from external risks as a slowing global economy will likely weigh on the country’s merchandise exports.

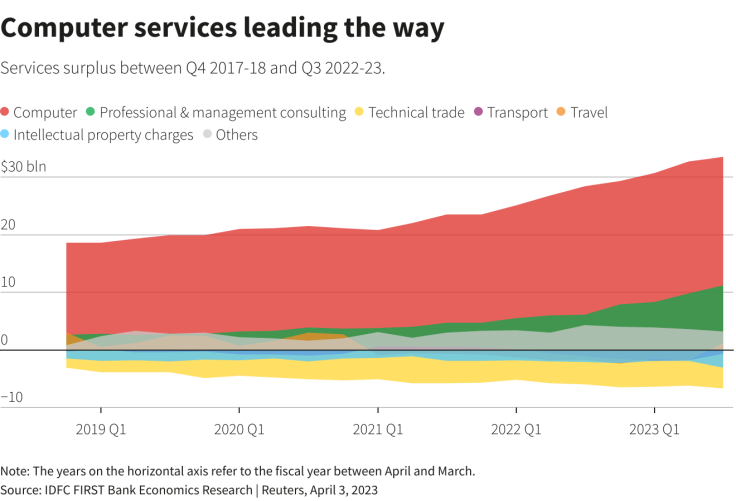

Service exports are no longer being driven by IT services alone but also by more lucrative offerings such as consulting and research and development, analysts and economists told Reuters.

India’s services exports rose 24.5% on year in October-December 2022, hitting a record $83.4 billion during the quarter, data released by the Reserve Bank of India (RBI) on Friday showed.

The services surplus, which deducts any imports in the category, also rose 39.21% to a record $38.7 billion.

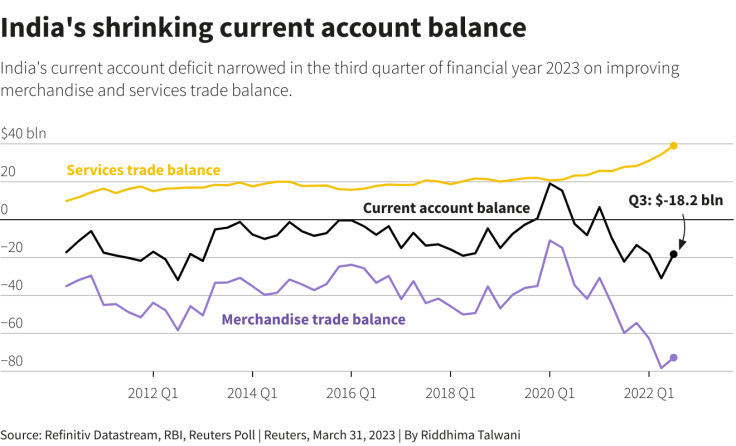

This, together with a drop in merchandise trade deficit, resulted in the current account deficit shrinking more than expected to $18.2 billion, or 2.2% of GDP.

“We expect services exports to grow to over $375 billion by March 2024, as compared to $320-350 billion for the year ending March 2023,” said Sunil Talati, chairman of the Services Export Promotion Council.

Services exports will likely surpass goods exports by March 2025, he said.

October-December merchandise exports stood at $105.6 billion, according to latest RBI data.

GRAPHIC – India’s shrinking current account balance India’s shrinking current account balance

IT services still accounted for 45% of India’s total services exports in April-December.

Professional and management consulting grew the fastest – at a 29% compounded annual growth rate over the last three years, as per estimates by economists at HSBC Securities and Capital Markets.

The recent growth in services exports has been largely powered by global capability centres, which have started to offer global clients a range of high-end and critical solutions such as accounting and legal support.

As a result, such exports will hold up better compared to goods exports in the face of a weakening global economy, analysts said.

Over the last two to three years, there has been a rapid growth in global capability centres, said Sangeeta Gupta, chief strategy officer at software industry lobby group Nasscom.

Nasscom estimates that India is home to over 45% of such global capability centres in the world.

According to Pranjul Bhandari, chief India economist at HSBC Securities and Capital Markets, such centres started off providing support functions, but they have now moved up the ladder to tech enablement, business operations, capability development, and even R&D and business development.

GRAPHIC – Computer services leading the way Computer services leading the way

While U.S. companies were the first movers in India, a lot of companies from Europe, Australia and Asia are also exploring stepping up their operations, Nasscom’s Gupta said.

An acceleration in digitalisation after the Covid crisis and a lack of adequate tech talent in some of these countries are key factors, she added.

Sectors such as tourism, education, financial services and health also contributed to India’s higher service exports.

EXTERNAL SHIELD

The continued rise in services exports is likely to help rein in India’s current account deficit.

“We now revise our CAD estimates for 2022-23 and 2023-24 to 2% ($68 billion) and 1.4% of GDP ($53 billion)respectively, from 2.6% and 2% earlier, said Vivek Kumar, an economist at QuantEco Research.

GRAPHIC – Scaling a new peak

However, sustaining services exports would partly depend on how demand conditions in developed markets hold up, said Gaura Sen Gupta, India economist at IDFC FIRST Bank.

“India has a comparative advantage in services exports, particularly in software services. There is room for further growth with India’s share in world commercial services exports currently just at around 4%.”

Reuters