KEY POINTS

- Icahn allegedly used money from new investors to pay for dividends of old investors

- The activist investor was also accused of not disclosing the exact amount of his loans

- Icahn and Bill Ackman had feuded in the past over a company the latter accused of pyramid scheming

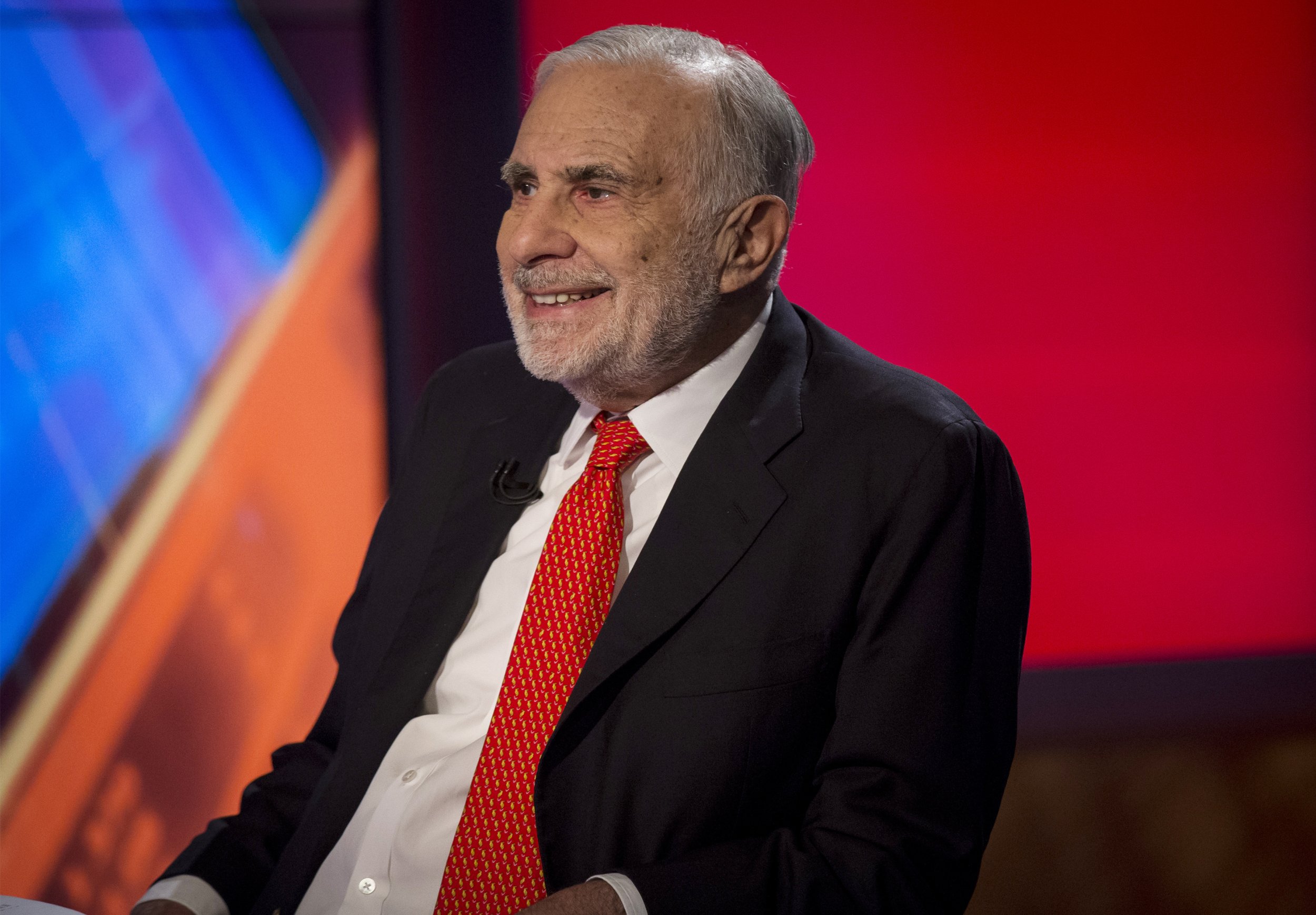

Corporate activist and investor Carl Icahn has lost more than $10 billion after short-seller Hindenburg Research published a scathing report, which accused the financier’s company of utilizing a “Ponzi-like” economic structure.

Icahn lost roughly $10.1 billion from his fortunes after the shares of his holding company Icahn Enterprises (IEP) fell by 20%, following the release of the Hindenburg report on Tuesday, according to Bloomberg.

Before Tuesday, Icahn took the 58th spot in the Bloomberg Billionaires Index. On Tuesday, his wealth fell by 41% to $14.6 billion. As of Wednesday, the investor is ranked No. 133, and has an estimated net worth of $13.6 billion, according to the index.

The Hindenburg report accused Icahn’s investment company of inflating its valuation by around 75% or more and using an economic structure similar to Ponzi schemes.

“In brief, Icahn has been using money taken in from new investors to pay out dividends to old investors. Such Ponzi-like economic structures are sustainable only to the extent that new money is willing to risk being the last one ‘holding the bag,'” the short-seller wrote.

Hindenburg went on to accuse Icahn of failing to disclose the exact amount of his loans. The investment mogul has been reporting a margin loan collateralized by his IEP stakes in 2021. That year, he had about 65% of his shares pledged and by 2022, he had more than 181 million shares worth $9.2 billion to support the loan, reported Bloomberg.

Bill Ackman, Icahn’s old rival in the investment circle, commented on the matter, seemingly reigniting an old feud.

“There is a karmic quality to this short report that reinforces the notion of a circle of life and death. As such, it is a must read,” he tweeted.

Ackman and Icahn feuded over a decade ago after the former made a $1 billion bet against nutrition company Herbalife, as per Insider. Ackman accused the dietary supplements’ provider of using a pyramid scheme.

The feud resulted in a live exchange on TV via CNBC. “This is a guy who takes advantage of little people,” Ackman said of Icahn.

Icahn later invested in Herbalife.

In 2016, Herbalife settled with the Federal Trade Commission (FTC) for $200 million after the commission said the company cheated salespeople in the millions through its multi-level marketing scheme.

Icahn has since sold all of his Herbalife stocks back to the company and also exited five board seats held by his company, as per CNBC.

Responding to the Hindenburg report, Icahn said in a statement to CNBC that IEP stands by its public disclosures.

“IEP’s performance will speak for itself over the long term as it always has,” Icahn said. “We continue to believe that activism is the best paradigm for investing and my activist investments over the last 25 years have well proved this out.”

Icahn, who has an 85% stake in IEP, has been pressing for changes in some companies over the years, including at Xerox, McDonald’s and Southwest Gas Holdings, Reuters reported.

In August last year, longtime McDonald’s board member Sheila Penrose retired after Icahn pressed the food giant over how the company sourced its pork products. While McDonald’s did not say why Penrose was retiring, Icahn reportedly sought to unseat Penrose and another board member.

Icahn is the most recent figure targeted by Hindenburg Research, after the short-seller published a March report that accused payments company Block of overlooking fraudulent activities on the platform and misleading investors.

As a result of the said report, Block co-founder and CEO Jack Dorsey reportedly shed around $526 million from his fortune. Before the report emerged, the Twitter co-founder was No. 456 on the Bloomberg Billionaires Index, but his name soon disappeared from the list of the world’s 500 richest people.

Earlier this year, Hindenburg also accused India’s Adani Group of “brazen stock manipulation” and engaging in accounting fraud for decades. The short-seller said Adani Group defrauded around $218 billion through its schemes.

The company’s stocks plummeted shortly after the report was released, resulting in $12 billion lost in Adani Group’s market value.

reuters/brendan mcdermid