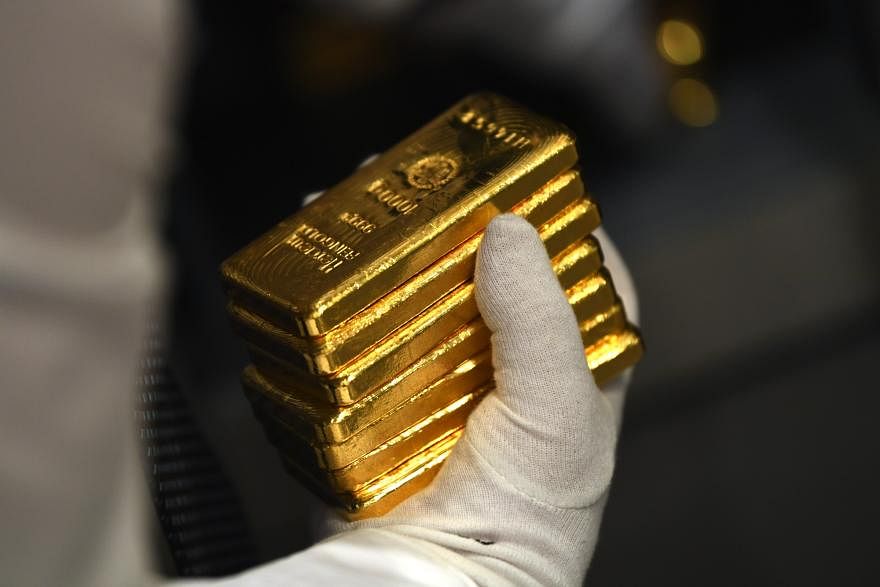

GOLD prices were headed on Friday (Mar 15) for their first weekly fall in four as surprisingly hot United States inflation readings suggested that the Federal Reserve could reduce the number of rate cuts this year and may push the first cut beyond June.

Spot gold was up 0.1 per cent at US$2,162.66 per ounce, as at 0144 GMT, but on track to post a weekly fall of more than 0.5 per cent, its first since mid-February.

US gold futures were steady at US$2,167.00.

US producer prices increased more than expected in February amid a surge in the cost of goods such as petrol and food, which could fan fears that inflation is picking up again.

Higher inflation adds pressure on the US Fed to keep interest rates elevated, weighing on non-yielding assets such as gold.

A reading on consumer inflation earlier this week also showed some stickiness in inflation.

Other data showed US retail sales rebounded last month, but were below analyst estimates, as households grapple with inflation and higher borrowing costs, while fewer people sought unemployment claims.

Traders have pared back the chances of a rate cut at the US Fed’s June meeting to 61 per cent, from about 75 per cent last Friday, according to LSEG’s rate probability app. For 2024, market sees about three rate cuts, down from between three to four last Friday.

The US dollar index rose 0.7 per cent this week so far, on pace for its largest weekly gain since mid-January.

Investors also kept a tab of brewing geopolitical risks between Russia and Ukraine as a senior Ukrainian intelligence official said two border regions have turned into “active combat zones”.

Spot platinum fell 0.2 per cent to US$926.10 per ounce, palladium dropped 1 per cent to US$1,058.53, while silver was up 0.4 per cent at US$24.93. All three metals were poised to clock a weekly gain. REUTERS