The story of a little girl who has been dubbed her country’s youngest homeowner has generated headlines and questions from around the world

Article content

The youngest known homeowner in Australia has sparked a flurry of questions from curious Canadians online.

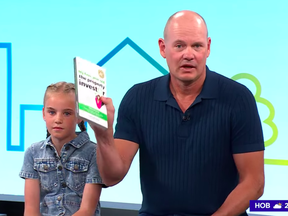

The story came to light after the girl’s father, Cam McLellan, CEO of property investment company OpenCorp, appeared on Today.com this month alongside his daughter, Ruby. McLellan also promoted his book, My Four-Year-Old the Property Investor.

Article content

McLellan explained that Ruby, 8, and her three siblings are all listed on the title after their parents helped them acquire their first home in December 2021 after the children spent years saving “pocket money,” which amounted to more than $5,000.

Advertisement 2

Article content

Their parents topped up the deposit for the home, which was purchased for $596,000 in December 2021.

“We get kids to do their chores, so time spent for money earned, but we realized that in 10 years time, when it gets to buy property, the deposits can be astronomical,” he told Today.com. “And it will be funded by the bank of mom and dad. So we thought it was so smarter to buy one property now.”

McLellan controls the trust, and the plan is to sell the house down the road, giving each of the children “enough to get started.”

The strategy has prompted questions about its legality and tax implications. Here’s what to know.

Recommended from Editorial

Is it tax fraud to list the name of the minors on property title?

McLellan said the strategy is about teaching his children “smart investing,” adding that the home has already increased in value and is currently “positively geared,” meaning the rental income is outpacing the mortgage payments, which is a legitimate investment strategy.

Article content

Advertisement 3

Article content

McLellan said he’s also discussed with his children the tax requirements upon selling the property. Tax fraud would involve intentionally deceiving tax authorities, which is not indicated by information the family has shared.

The strategy could be similarly applied in Canada. Any income generated from a property, including capital gains from its sale, would need to be reported to the Canada Revenue Agency (CRA). In the case of the property being owned by a minor, any income generated may be attributed back to the parents for tax purposes, depending on how the investment was structured.

Can minors own property in Canada?

Minors can legally own property in Australia, but there are restrictions on their ability to manage it until they reach the age of majority.

By placing the property in a trust and putting their names on the title, McLellan is ensuring that the property is cared for until they are old enough to manage it themselves.

The rules are similar in Canada. A minor can legally own property, but there are specific legal considerations and restrictions regarding their ability to manage it. Typically, a property will be placed in a trust, or a guardian will manage it until the owner reaches the age of majority.

Advertisement 4

Article content

Trusts can specify how a property is to be managed, who can make decisions about the property, and how and when the property may be sold or transferred.

Could the same thing happen in Canada?

Similar investment strategies have happened here, where parents use trusts to facilitate property investments for their children.

The investment strategy needs to consider tax implications, especially regarding rental income and capital gains tax upon selling the property. Canada’s tax system has provisions for dealing with income generated by minors, including the attribution rules, which might apply in cases where income could be attributed back to the parents depending on the source of the investment funds.

Tyson George from London, Ont., for example, purchased his first property at age 15 after saving money by buying, refurbishing and reselling items he found at auctions and garage sales.

His initial savings were boosted by birthday and Christmas gifts, and he learned the ins and outs of real estate from his mother, a realtor, CBC reported in 2019. His parents signed mortgages that were entrusted to him, and George said he had a long-term goal of owning 100 rental properties by the time he turned 30.

George is currently a sales representative with Ontario-based Elite Choice Realty, Inc.

Our website is the place for the latest breaking news, exclusive scoops, longreads and provocative commentary. Please bookmark nationalpost.com and sign up for our daily newsletter, Posted, here.

Article content