THE latest US inflation data is “along the lines of what we would like to see”, Federal Reserve chair Jerome Powell said on Friday (Mar 29) in comments that appeared to keep the central bank’s baseline for interest rate cuts this year intact.

The personal consumption expenditures (PCE) price index data released on Friday “is what we were expecting”, Powell said, and even though the numbers showed less of a slowdown than last year “you won’t see us overreacting”.

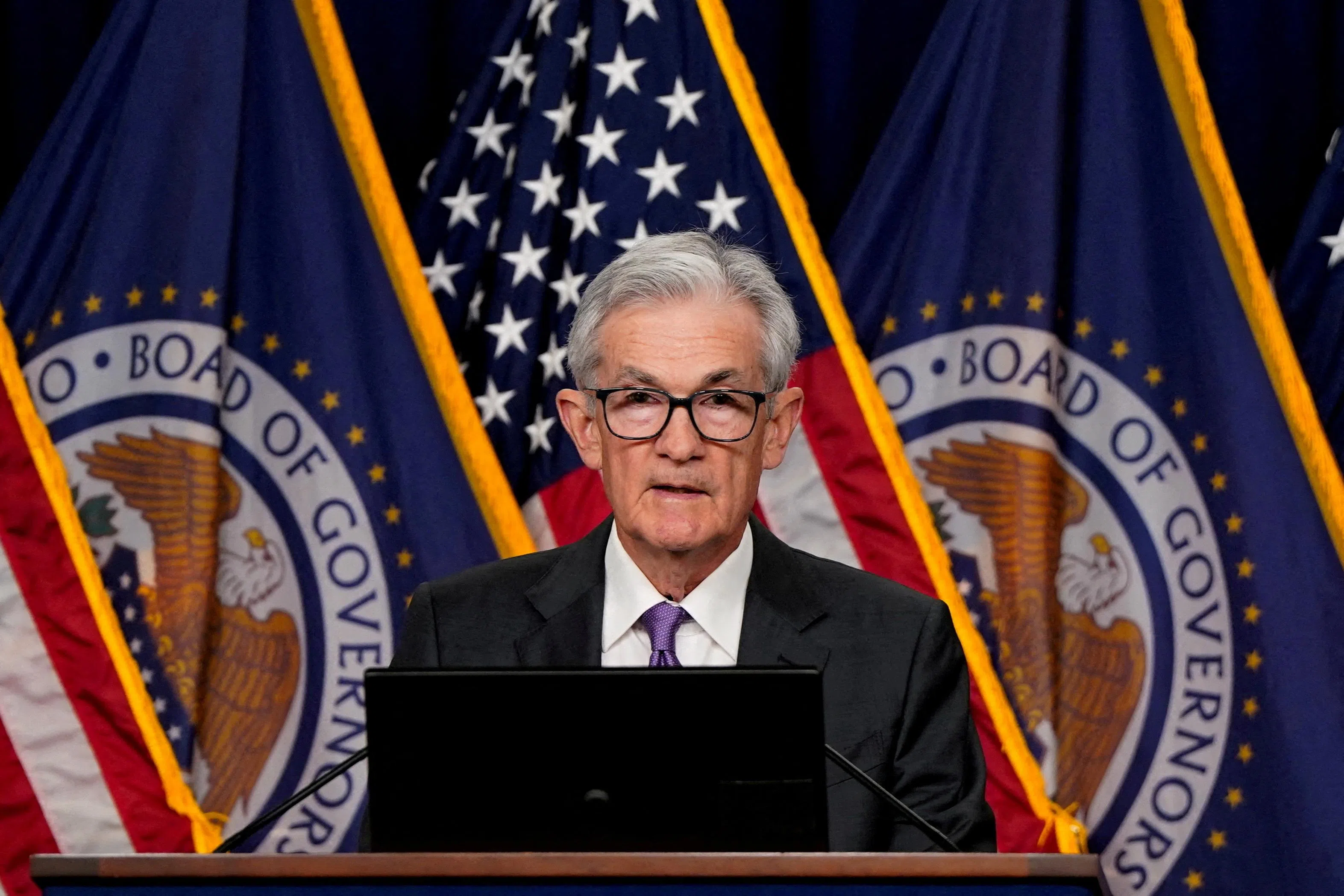

Powell was speaking during an appearance at the San Francisco Fed where he was interviewed by Kai Ryssdal of public radio’s Marketplace programme.

Government data showed the PCE price index increased at a 2.5 per cent annual rate in February, up from 2.4 per cent in the prior month. The number excluding volatile food and energy prices rose 0.3 per cent on a month-to-month basis, slightly faster than Powell anticipated when he said last week that February core inflation would be “well below” 0.3 per cent.

Still, Powell indicated the February report did not undermine the Fed’s baseline outlook.

Some details of the PCE data, economists noted, did show improvement in aspects of inflation that the Fed considers important, even as the headline numbers have shown little progress in the first two months of the year.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

The Fed last week held its benchmark overnight interest rate steady in the 5.25 to 5.50 per cent range and also reaffirmed – narrowly – a baseline projection that the rate will fall by 0.75 percentage point by the end of this year.

Powell in recent weeks has had to reconcile expectations for rate cuts to begin this year with data showing improvement in the inflation numbers has slowed, if not stalled.

In the past three weeks the Fed chief has said the central bank was “not far” from the point where it would be comfortable cutting interest rates, then refused to repeat the thought when given the opportunity. He has said recent high inflation did not change the overall “story” of easing price pressures but also noted that recent data could not be completely dismissed as a signal of slowing progress. REUTERS