IT HAS not been smooth sailing for Reits over the recent months with higher interest rates adding pressure to share prices and valuations.

Despite this, S-Reits are now trading at a discount of close to 20 per cent compared to their longer-term averages in terms of price-to-book ratios.

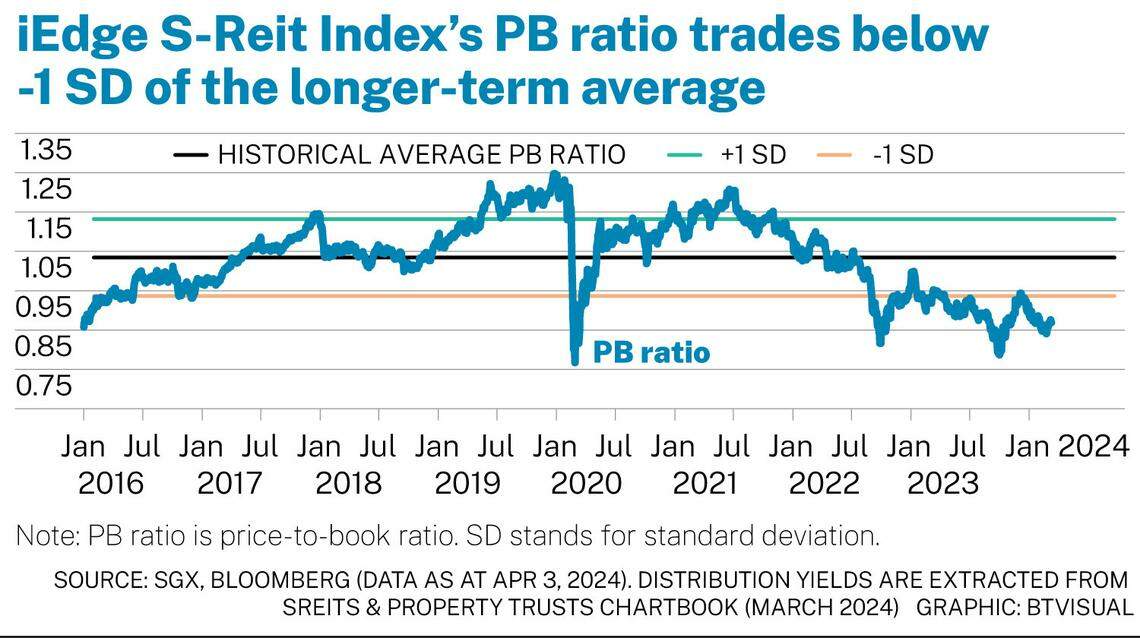

This is indicated by the iEdge S-Reit Index currently trading at a price-to-book (PB) ratio of 0.87 times, against the index’s five-year average PB ratio of 1.04 times – which showed a discount of 16 per cent.

Over a longer trading period going back to early 2016, based on the availability of data, the S-Reit sector is now trading at one standard deviation (SD) below (or 18 per cent discount) its historical PB ratio.

Within the iEdge S-Reit Index, the 10 largest member constituents make up just over 70 per cent of the total weights. These 10 S-Reits are currently trading at a PB ratio which is at a 17 per cent discount to their five-year average. The iEdge S-Reit Index and associated variant indices provide benchmarks for a number of portfolio products such as ETFs, robo advisories such as SYFE Reit+ Portfolio, index funds, and futures contracts.

Out of the 10 index heavyweights, the five S-Reits that are trading at larger discounts to their five-year average price-to-book ratios are Mapletree Pan Asia Commercial Trust : N2IU 0%, Keppel DC Reit : AJBU 0%, Frasers Logistics & Commercial Trust : BUOU 0%, Keppel Reit : K71U 0%, and Mapletree Industrial Trust : ME8U 0%.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Keppel Reit recently announced that it has entered into a contract of sale to acquire an effective 50 per cent interest in 255 George Street, a freehold Grade A office building in Sydney, Australia, for A$363.8 million (S$323 million).

The property is located within Sydney’s CBD Core Precinct and has a committed occupancy rate of 93 per cent and has a weighted average lease expiry of 6.8 years. Keppel Reit’s manager expects the property to generate a first-year yield that exceeds 6 per cent and distribution per unit accretion of 1.4 per cent on a pro forma basis. Some of its key tenants, across a diversified tenant base ranging across various industries, include the Australian Taxation Office and the Bank of Queensland.

Post-acquisition, Keppel Reit’s Singapore-centric portfolio will be approximately S$9.6 billion across 13 properties in Singapore (76.5 per cent of its assets under management (AUM)), Australia (19.3 per cent of AUM), South Korea (3.3 per cent of AUM) and Japan (0.9 per cent of AUM).

The iEdge S-Reit Index is widely seen as one of S-Reits’ barometers and measures the performance of Reits listed in Singapore. Within the index are 31-member constituent S-Reits, and the index has a distribution yield of 5.7 per cent. There are currently two exchange traded funds (ETFs) listed in Singapore that are pure-play S-Reit ETFs – the CSOP iEdge S-Reit Leaders Index ETF and the Lion-Phillip S-Reit ETF.

Reit ETFs provide investors with instant diversification and access to Reits, as they track the performance of an underlying index – in this case a basket of Reits. Buying an ETF is also less costly than if one were to build a similar portfolio by buying the individual Reits. Investors can also invest in the Reit ETFs using a Regular Shares Saving Plan. SGX RESEARCH

The writer is a research analyst at SGX. For more research and information on Singapore’s Reit sector, visit sgx.com/research-education/sectors for the monthly S-Reits & Property Trusts Chartbook.

Source: SGX Research S-Reits & Property Trusts Chartbook