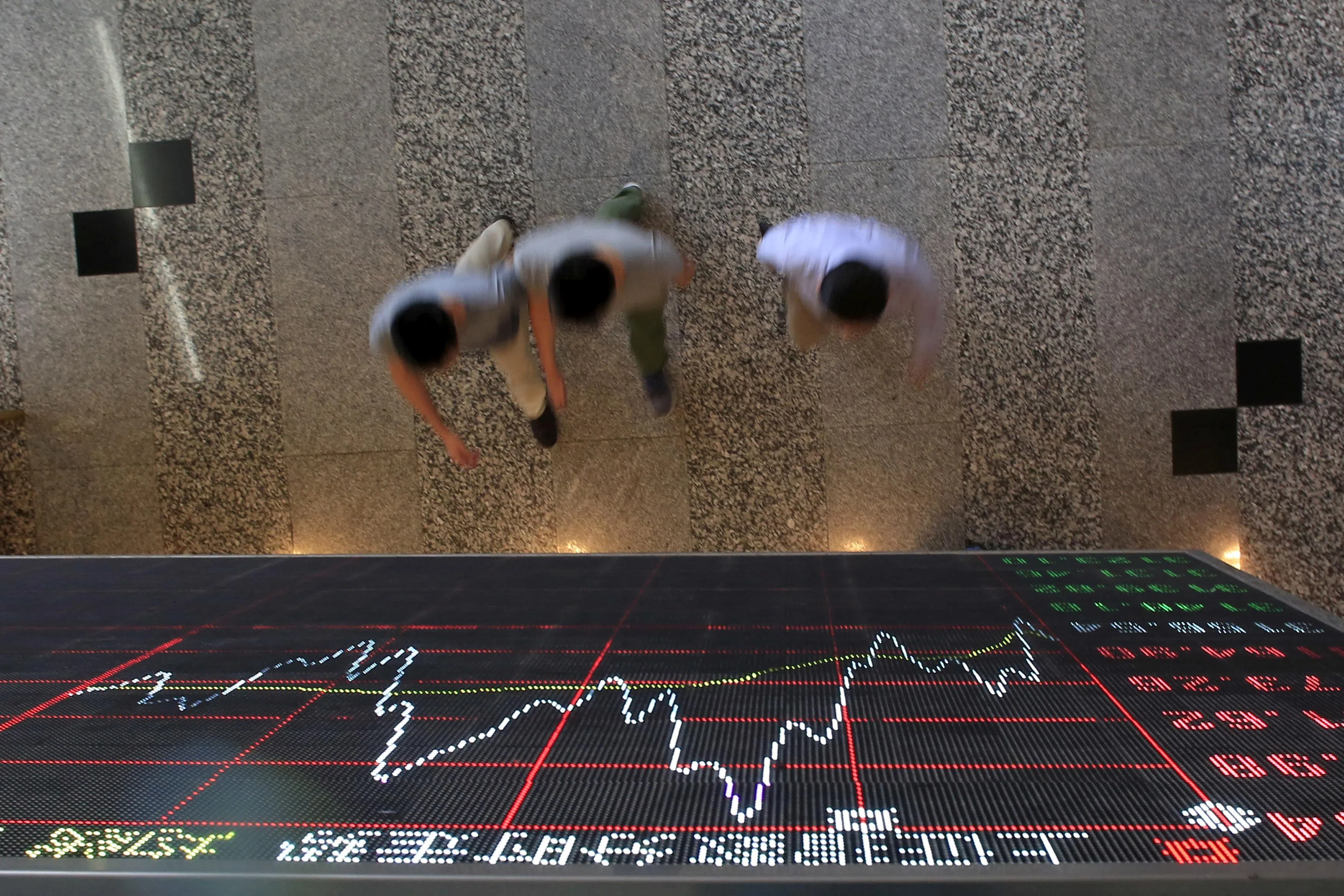

UBS Group raised its recommendation on a key Chinese stock index to overweight in a rare upgrade call this year, underscoring the tentative optimism that the market is finally on the mend.

“The largest stocks in the China index have been generally fine on earnings and fundamentals,” strategists including Sunil Tirumalai wrote in a Tuesday (Apr 23) note. UBS is now even more positive on earnings given early signs of a pickup in consumption, with the possibility of household savings flowing into spending and eventually markets, the note said.

The bullish call for the MSCI China Index arrives at a pivotal time. Shares had been emerging from a multi-year slump, thanks to green shoots in the economy as well as signs of improving corporate performance. However, lingering risks from geopolitical tensions and potential regulatory whiplash have made investors wary of going all-in on the asset class.

The Swiss bank, which also upgraded Hong Kong shares to overweight, is in turn downgrading the tech-heavy markets of Taiwan and South Korea to neutral.

The strategists said the sustained outperformance of the chip sector has led to “decade-high premiums to rest of the universe”.

The rotation out of tech sectors has been gathering momentum as the Federal Reserve looks set to keep rates higher for longer in a blow to stocks with frothy valuations.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

While Chinese equities have rebounded from their early 2024 lows, brokerages have been reluctant to boost their index targets or upgrade recommendations. The MSCI China Index has gained more than 13 per cent since a January trough, while the Hang Seng Index has rebounded about 12 per cent.

The reservations are likely due to caution from misplaced calls during the late 2022 reopening frenzy, when an epic rally was soon superseded by a relentless sell-off that lasted until earlier this year.

Consumption pickup

UBS downgraded Chinese shares to neutral in August 2023 as it awaited policy stimulus and the property market to stabilise. That followed its peer Morgan Stanley’s move in the same month, which also cut its rating to equal-weight.

China’s consumer-sector results have generally been positive, with liquor maker Kweichow Moutai reporting higher-than-expected earnings for 2023. Delivery giant Meituan’s fourth-quarter revenue and net income beat estimates.

The 12-month forward earnings estimate for the MSCI China Index has risen 1.7 per cent this month, rebounding from the lowest since end-2022, according to data compiled by Bloomberg.

Other tailwinds boosting Chinese stocks include support from the national team, which put a floor under an earlier rout, as well as a slew of positive surprises on dividends and buybacks from local firms, the UBS strategists wrote.

In what many investors saw as a major push towards market reforms, China’s Cabinet released a “Nine-Point Guideline” which included measures to encourage dividend payments, improve the quality of new stock offerings and plug corporate governance loopholes.

The biggest risk to the stocks now is “heightened geopolitical noise in the run-up to US elections”, the strategists wrote. BLOOMBERG