Hong Kong’s central bank chief and executives at UBS Group and HSBC called for the expansion of wealth links between the city and mainland China, months after a key initiative was bolstered.

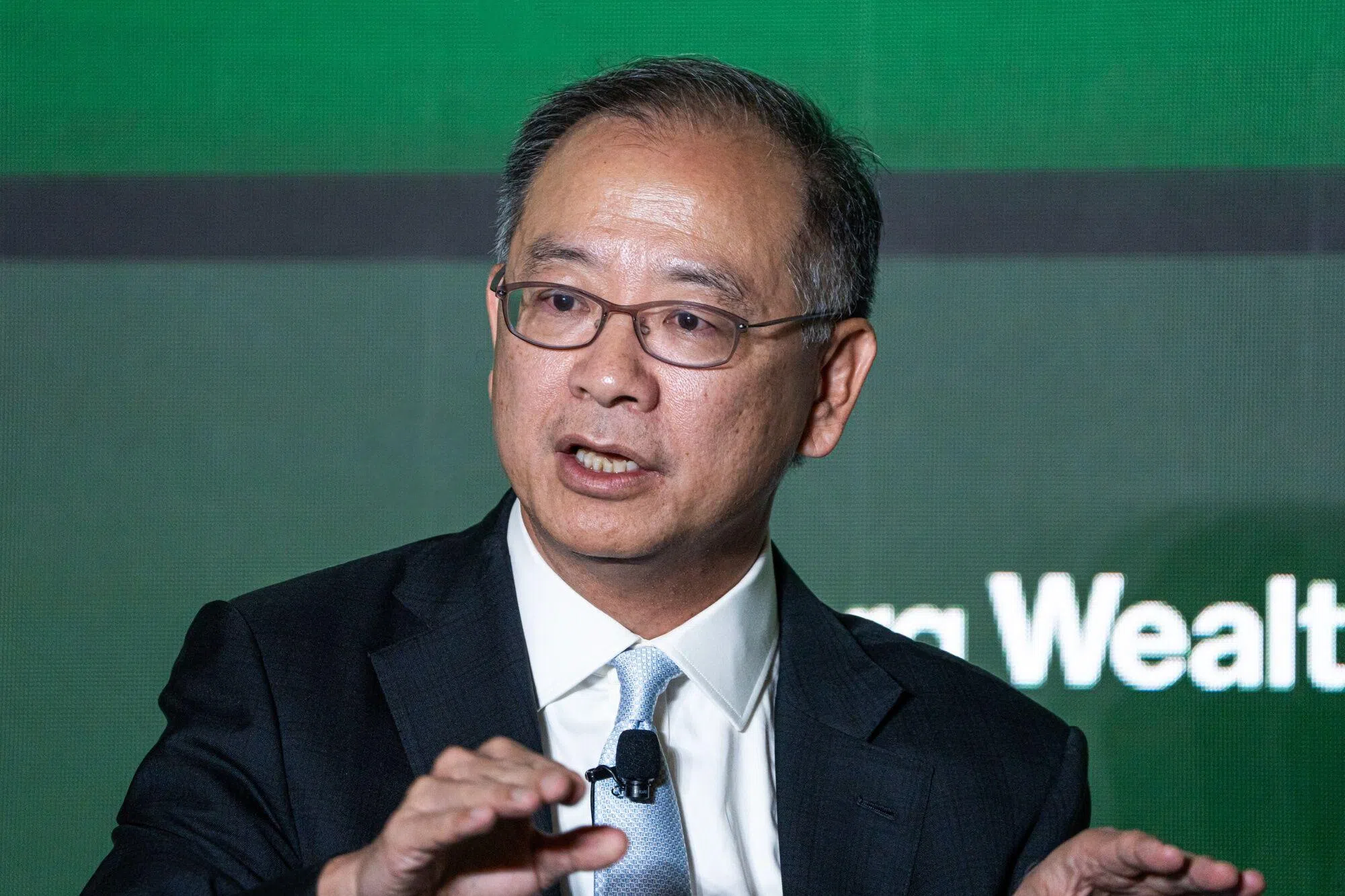

The Hong Kong Monetary Authority is in talks with the industry about potential further increasing the Wealth Management Connect programme to accommodate the needs of richer investors, chief executive Eddie Yue said at the Bloomberg Wealth summit in the city on Wednesday (Jun 5).

The authorities have been stepping up efforts to financially integrate Hong Kong to the mainland after the city struggled following years of strict Covid policies, and the imposition of a national security law in 2020. The quota for the Wealth Connect programme for individuals to invest in Hong Kong was tripled to three million yuan (S$557,600) in February.

The current quota is “not quite enough for private bank clients” who need to diversify their assets, Yue said. He also asked whether there is a way to have a “separate channel” to capture such customers.

UBS’ Asia wealth chief Amy Lo agreed that the quota has failed to attract private bank clients.

“One of the strengths of Hong Kong is the advisory capability and the breadth and depth of product offerings,” Lo, chairman of global wealth management for Asia, said at the same event. She said there is a need to relax the current “execution-only” model to allow banks to advise clients under the programme.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Annabel Spring, HSBC’s global private banking and wealth chief executive officer, said she was “delighted” to hear Yue talk about wealth connect channels widening and amounts going up.

The Wealth Connect, which allows residents in major southern Chinese cities such as Shenzhen and Guangzhou to invest in Hong Kong, has picked up since the quota was expanded. Southbound sales surged to 22.3 billion yuan in April, up from just 382 million yuan a year earlier. BLOOMBERG