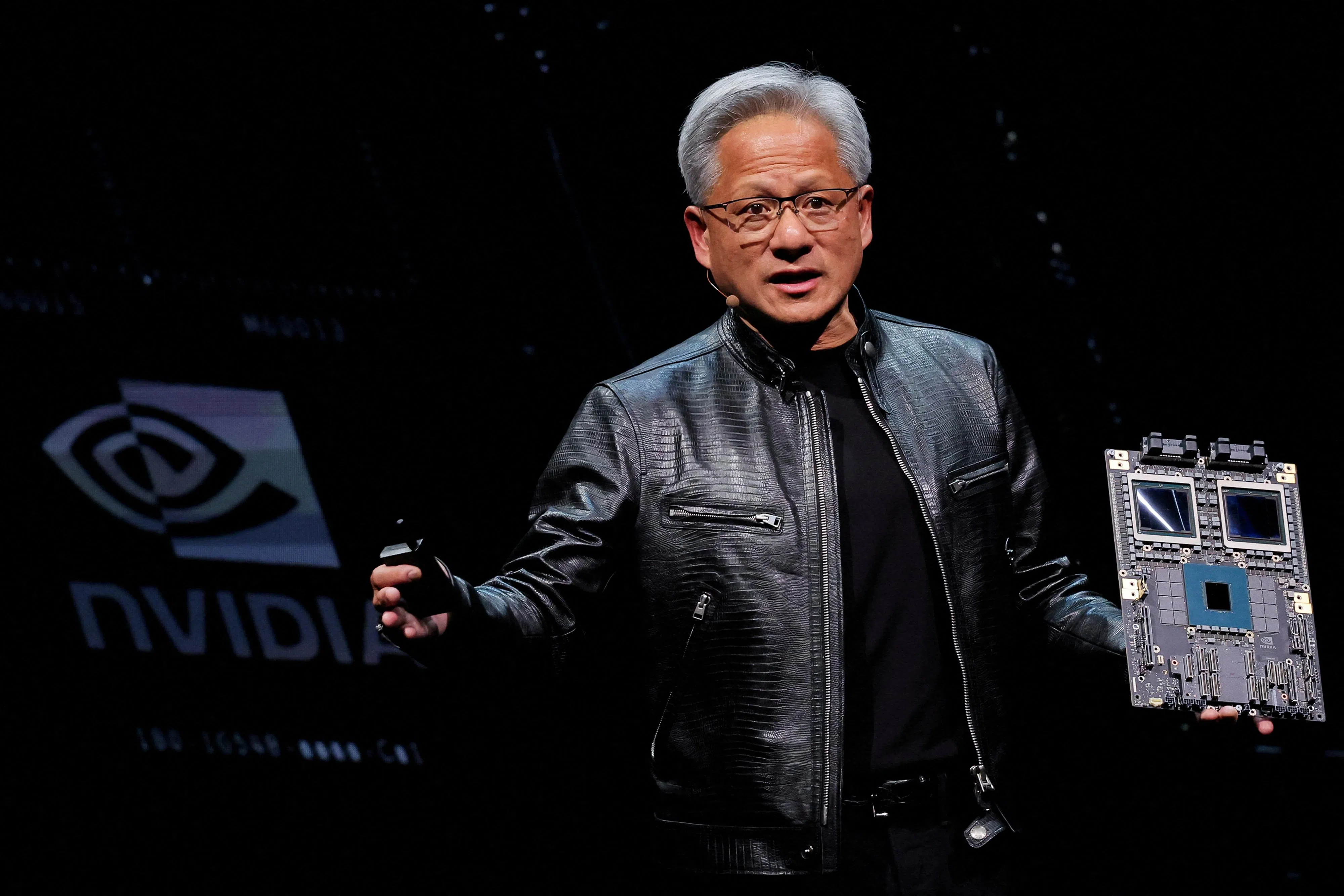

Nvidia’s Jensen Huang has steadily climbed the ranks of the world’s wealthiest as the market value of his computer-chip maker touches $3 trillion.

Huang hit another milestone on Friday (Jun 7), passing personal computer pioneer Michael Dell to become the world’s 13th-richest person with a net worth of US$106.1 billion, according to the Bloomberg Billionaires Index. His wealth has surged more than US$62 billion this year as demand for Nvidia chips used to power artificial intelligence (AI) tasks remains insatiable.

Huang, 61, is leading a new wave of tech billionaires as AI-fuelled “Jensanity”, as one analyst termed it, takes over Silicon Valley. Other beneficiaries include Lisa Su, chief executive officer of Advanced Micro Devices (AMD), as well as Super Micro Computer’s Charles Liang. Last month, Huang’s fortune surpassed each individual member of the Waltons, America’s richest family following another blowout quarter from the chipmaker.

Huang’s wealth is derived from his 3.5 per cent stake in Santa Clara, California-based Nvidia, which he co-founded in 1993 with Chris Malachowsky and Curtis Priem. Nvidia became the first computer-chip company to hit US$3 trillion in market capitalisation on Wednesday, surpassing the value of Apple, and was flirting with that benchmark again on Friday.

Dell, 59, with a net worth of US$105.9 billion, has been a computer hardware-industry outlier among the tech super-rich, which often owe wealth to software companies. Dell made much of his fortune through his namesake firm, which sells personal computers and servers.

Still, Dell Technologies has been a beneficiary of the recent AI success as corporations need servers and other infrastructure to utilise advanced chips from Nvidia. Investors have increasingly seen Dell, along with Super Micro, as Nvidia’s chosen partner for this business line.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

In early March, Dell joined the small group of people with fortunes exceeding US$100 billion as the company’s shares rose to a record high. The stock has since retreated after posting results that disappointed investors, reducing its founder’s wealth almost US$12 billion in a single day.

Nvidia today commands an ecosystem of hardware and software solutions that rivals from AMD to Intel are trying hard to break up or replicate, thanks to its dominant share of the market for the high-end accelerators used to train AI.

And it has shown no signs of slowing down or letting its rivals catch up. Huang said the firm plans to upgrade its so-called AI accelerators every year. BLOOMBERG