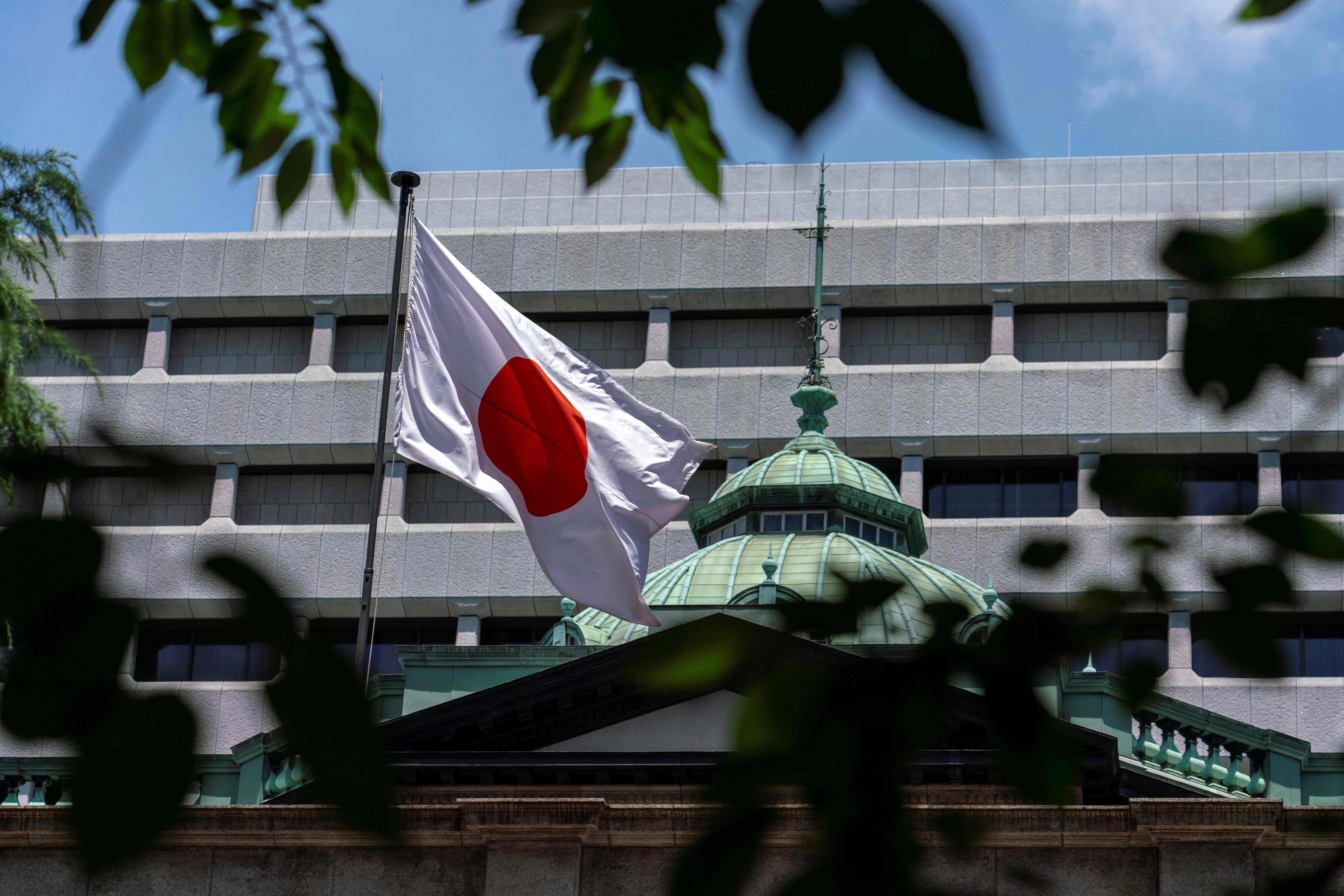

Japanese financial institutions’ profitability has decreased significantly in the past 25 years, making them vulnerable to potential losses from any sharp rises in interest rates, the central bank said on Thursday (Jun 20).

While many companies increased long-term, fixed-rate loans to take advantage of Japan’s ultra-low interest rates, some have suffered sluggish profits, the BOJ said in a report.

Banks’ lending to such low-profit firms may turn sour as interest rates begin to rise, the BOJ said in the report, which looked into the impact prolonged monetary easing had on Japan’s banking system.

“Financial institutions’ profitability has decreased sharply in the past 25 years,” with some regional lenders becoming more vulnerable to stress, the report said.

“If interest rates rise sharply in a short period of time, financial institutions could incur latent losses on their securities holdings,” which in turn could discourage them from lending, it said.

The report was compiled as part of a comprehensive review the BOJ is conducting on the pros and cons of past monetary easing steps.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

The assessment underscores the BOJ’s focus on how prospects of rising interest rates could affect Japan’s banking sector, which have weathered a long period of ultra-low rates.

Since deploying a massive asset-buying programme in 2013, the BOJ has kept interest rates ultra-low through a radical stimulus programme to fire up inflation to its 2% target.

While the ultra-loose policy helped companies by pushing down borrowing costs, it eroded financial institutions’ profits by crushing the margin they earn through lending.

In a landmark shift away from the radical monetary stimulus, the BOJ ended eight years of negative interest rates in March. It has also hinted of further hikes in the short-term policy rate from current levels around zero.

Upon becoming BOJ governor in April last year, Kazuo Ueda announced plans for a long-term review to scrutinise the effects and side-effects of the central bank’s radical stimulus. REUTERS