‘Alan could not handle losing our life’s savings and that is what lead to this tragic event,’ says the wife of Alan Kats who killed two and then himself

Article content

Alan Kats had angry words for two people he came looking for at a low-rise office building in Toronto on Monday afternoon — a witness heard arguing before the gunshots — but he also had much more in mind. He came to kill them, and then kill himself.

Kats, 46, left his wife a note before setting off to the North York office, where he found Arash Missaghi, described by a judge as a “predatory fraudster”, and Samira Yousefi, a pushy mortgage agent, who he blamed for defrauding the couple of their home and savings through an investment swindle that Missaghi had unrelentingly pulled on many people over many years, according to victims and police allegations.

Advertisement 2

Article content

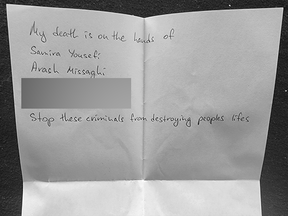

Kats’ note says his death is on the hands of four people, and then lists the two people he killed as well as two lawyers who allegedly facilitated the transactions.

“Stop these criminals from destroying peoples lifes,” says his note, handwritten with misspellings in blue ink on a folded sheet of paper.

Kats, also known as Vadim, and his wife, Alisa Pogorelovsky, were caught in an elaborate fraud and embroiled in a lawsuit against those they deemed responsible for the duplicity and their misfortune.

Their money, though, $1.3 million, seemed unrecoverable, with a judge noting the “predatory fraudsters” were “skillful at putting their asset” beyond the court’s reach.

What’s more, Kats and Pogorelovsky learned they were not the first people Missaghi had swindled, and were convinced they wouldn’t be the last. He seemed incorrigible and unstoppable, not by police, the courts, or investor complaints. Despite criminal charges, police probes, and lawsuits in Canada and the United States, Missaghi kept on swindling.

It was all too much for Kats, said Pogorelovsky.

Advertisement 3

Article content

“Alan could not handle losing our life’s savings and that is what lead to this tragic event,” she said in a statement. “The events that gave rise to the litigation that we are involved in with Missaghi and Yousefi have devastated and now destroyed our family.”

A GoFundMe campaign for Pogorelovsky and her two children describes Kats’ death as a sacrifice to stop the fraudsters from hurting others.

“Imagine this — you worked hard your whole life, started businesses, missed every important moment to selflessly support your loved ones, just to end up in the wrong hands and have everything you ever worked hard for be sinisterly stolen, leaving you in the darkness, with nothing to fall back on,” says the fundraising page started by a family friend.

The problems for Kats and Pogorelovsky started with a financial tip from a friend in 2019. He suggested the couple use the equity in their mortgage-free family home north of Toronto to invest in private mortgages.

Pogorelovsky and Kats both worked in construction, he as a general contractor and she as a project manager. They were neophytes to investing, but when their friend introduced them to Samira Yousefi, a mortgage agent, she made it sound easy.

Article content

Advertisement 4

Article content

Yousefi walked her through each step, Pogorelovsky said in a sworn affidavit filed in court as part of a lawsuit filed after the investment turned sour. Pogorelovsky obtained a home equity loan from CIBC for $1,375,000, secured by the house.

Pogorelovsky needed a lawyer to close the loan and Yousefi took care of that too, introducing her to one she worked with. The moment it was arranged, Yousefi was ready with two private mortgage deals and aggressively urged the couple to act fast.

“She was extremely pushy,” Pogorelovsky said. A text message filed in court shows Yousefi saying the money was needed in less than three hours because there were “too many investors waiting” to get in on the deal.

He was hugging me, saying that he loved me and he’s sorry for everything

The couple paid $850,000 for 25 per cent of a mortgage on a commercial building in Toronto, and another $400,000 in a mortgage on a bungalow in Richmond Hill. Yousefi brought in another lawyer to handle the details, their statement of claim alleges.

It was a poisonous deal.

“Ms. Yousefi and her alleged accomplices created a web of lies and false promises to defraud the plaintiff of the entirety of the CIBC mortgage proceeds,” a judge hearing a lawsuit in the matter later wrote.

Advertisement 5

Article content

The profits Pogorelovsky was promised weren’t coming, and Yousefi was slow to respond once she had their money. The couple eventually were sent a few cheques for about $7,000 each. It seemed the profits were finally coming in and the couple were even talked into putting another $80,000 into a mortgage on a waterfront property in New Liskeard, in northeastern Ontario.

By the summer of 2023, after broken promises and excuses, the couple finally started asking tougher questions.

To smooth things out, Yousefi arranged a meeting with a “lawyer partner” who, it later turned out, was Missaghi using a fake name and bogus credentials, their claim says.

The couple secretly recorded the meeting. “The money is safe,” Missaghi assured them, according to a transcript filed in court. Mortgages are the safest investments in the world, and he would sort everything out, he assured them.

His words meant nothing. By Christmas the couple were forced to sell their home, unable to afford the bank payments for their loan.

They finally went to an independent lawyer.

It was too late. They learned there were no mortgages on the properties they had invested in. They found a trail of schemes and fake transactions involving Missaghi and uncovered a network of shell companies linked to Missaghi and his relatives, their unresolved claim says.

Advertisement 6

Article content

Missaghi had been through this all before. He had become an unrepentant swindler of gullible people who trusted him and a wide array of associates with incredible amounts of money.

His schemes made him millions. Court heard that Missaghi controlled $50 million in North American assets.

Missaghi made headlines in 2018 when he was charged in Toronto after a $17-million mortgage fraud.

Imagine this — you worked hard your whole life, started businesses, missed every important moment to selflessly support your loved ones, just to end up in the wrong hands and have everything you ever worked hard for be sinisterly stolen

Toronto police called their investigation Project Bridle Path, after one of Toronto’s ritziest neighbourhoods, filled with mansions and millionaires. The charges came years after the allegations surfaced, partly because one of the lawyers who worked on the deals fled the country and lived in hiding until she returned to Canada and cooperated with police.

Missaghi was accused of masterminding bogus mortgages by having people pretend to be the owner of mansions and presenting forged documents to support the ruse.

At least three other lawyers had already lost their licence or been suspended for helping Missaghi and his associates in fraudulent real estate schemes, but the charges against Missaghi were eventually withdrawn. It is unclear why.

Advertisement 7

Article content

Similarly, Missaghi seemed unaffected by civil lawsuits from people claiming to be his victims.

In February, Kats and Pogorelovsky added their lawsuit to the pile of investors and victims seeking restitution. They asked a judge to grant an order freezing all of Missaghi’s and his associates’ bank accounts in hopes it might protect some of the couple’s lost money.

Judge R. Lee Akazaki of the Superior Court of Justice of Ontario said there was a strong case that Pogorelovsky, whose name the investments were made in, was “the victim of a sophisticated fraud” that used a “corporate shell game” in “an elaborate ruse to obtain the plaintiff’s money.”

Akazaki granted the freezing order, but that too seemed to have no impact on Missaghi or Yousefi. They didn’t appeal the order.

“That is somewhat telling, in that all the remaining defendants managed to stay functioning, and even some hiring lawyers,” Akazaki wrote in May. That suggested they were “skillful at putting their assets” out of reach.

Kats seemed to believe that.

It was 3:35 p.m. when Toronto police were called to the lobby of an office building near Don Mills Road and York Mills Road for reports of a shooting; 25 Mallard Road is a registered business address for Yousefi, and for other corporations connected to Missaghi. Court records say Missaghi also did business there and met with client-victims there.

Advertisement 8

Article content

Officers found three bodies: Missaghi, 54, of Toronto, and Yousefi, 44, of Concord, north of Toronto.

Police haven’t publicly identified the third, saying only a 46-year-old man believed responsible for the shooting was among the dead. Toronto police did not provide more information or comment on the case prior to deadline.

Pogorelovsky identified it as her husband to help explain “what he was thinking and why he acted as he did.”

Pogorelovsky said her husband was emotional before he left the house that afternoon.

“He was hugging me, saying that he loved me and he’s sorry for everything,” she told CTV Toronto. “He was in depression, he couldn’t sleep.

“It’s just destroyed me, destroyed my family.”

• Email: ahumphreys@postmedia.com | X: AD_Humphreys

If you’re thinking about suicide or are worried about a friend or loved one, please contact the Canada Suicide Prevention Service at 1.833.456.4566 toll free or connect via text at 45645, from 4 p.m. to midnight ET. If you or someone you know is in immediate danger, call 911.

Our website is the place for the latest breaking news, exclusive scoops, longreads and provocative commentary. Please bookmark nationalpost.com and sign up for our daily newsletter, Posted, here.

Article content