[ad_1]

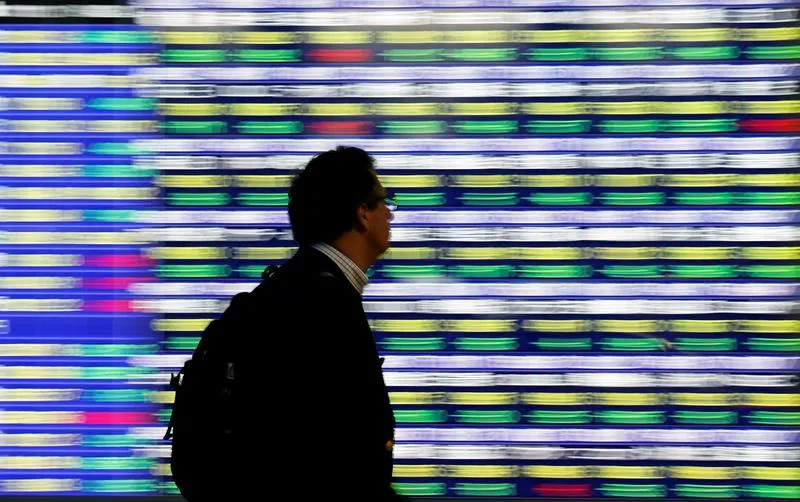

ASIAN markets sank with Wall Street on Thursday (Jul 18) after a warning from the White House that it would target firms supplying China with key semiconductor technology, and Donald Trump’s comments on crucial chip supplier Taiwan.

The US dollar remained subdued following its latest retreat caused by growing expectations that the Federal Reserve will cut interest rates at least once this year.

Firms linked to artificial intelligence have led a surge in equities this year as investors see the sector as the next major growth area, with market darling Nvidia piling on more than 140 per cent since the start of the year.

The industry has helped push the S&P 500 and Nasdaq to multiple records in the past seven months, helped by the prospect of lower borrowing costs.

But the rally took a blow on Wednesday when Bloomberg News reported that Joe Biden was looking at imposing strict curbs on firms such as Tokyo Electron and ASML if they continue allowing Beijing access to their chip tech.

The report, which comes as he looks to buttress his credentials as strong on China ahead of November’s presidential election against Trump, sent shivers across trading floors, sending the Philadelphia Semiconductor Index plunging nearly seven per cent – its heaviest loss since 2020.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Nvidia dived more than six per cent and Dutch firm ASML collapsed more than 12 per cent.

Tokyo Electron fell 7.5 per cent on Wednesday and a further 9.5 per cent on Thursday. TSMC shed more than three per cent in Taipei.

Meanwhile, Trump’s comments that Taiwan – home of the key chipmaker TSMC and other major producers – should pay the US for its defence caused some geopolitical unease.

The fear fuelled a sell-off across Asian equities, with Tokyo and Taipei down at least 2 per cent, while there were also hefty losses in Hong Kong, Shanghai, Sydney, Seoul, Singapore and Manila.

Analysts warned that the imposition of more chip restrictions could fuel further selling and lead to a correction in markets, which some warn have become overbought.

A big currency problem

Worries over tech have offset the feel-good mood that has been sparked by recent data and comments from Fed officials indicating they are ready to cut interest rates as soon as September, and possibly again before January.

The latest boost for doves came in the central bank’s Beige Book summary of the economy, which said there were signs it was slowing.

“Expectations for the future of the economy were for slower growth over the next six months due to uncertainty around the upcoming election, domestic policy, geopolitical conflict, and inflation,” the report said.

The prospect of lower rates has weighed on the US dollar, while the yen – which has been battered against the greenback this year – has won support from bets on a Bank of Japan hike in the coming months.

“Markets are pricing in the Fed to start cutting rates in September, and risks of yen carry trade – the practice of borrowing low yielding currencies to invest in high yielding currencies – unwinding are building as yield gap narrows,” Saxo researchers said.

“Recent comments from Trump have also hinted at concerns from US dollar strength.”

Trump, in Milwaukee for the Republican National Convention, has also weighed in on the US dollar’s relative strength against the yen and yuan, telling Bloomberg Businessweek “we have a big currency problem” and “I would always notice they fought very hard to keep their currency low”.

Taylor Nugent, at National Australia Bank, said: “The comments play to the view (that) bilateral trade deficits and currency valuations are a key focus, and tariffs would be a key negotiating tool.”

Investors are keeping tabs on Beijing, where China’s leaders are expected to wrap up a key gathering, with hopes President Xi Jinping will unveil fresh measures to boost the world’s number two economy. AFP

[ad_2]

Source link