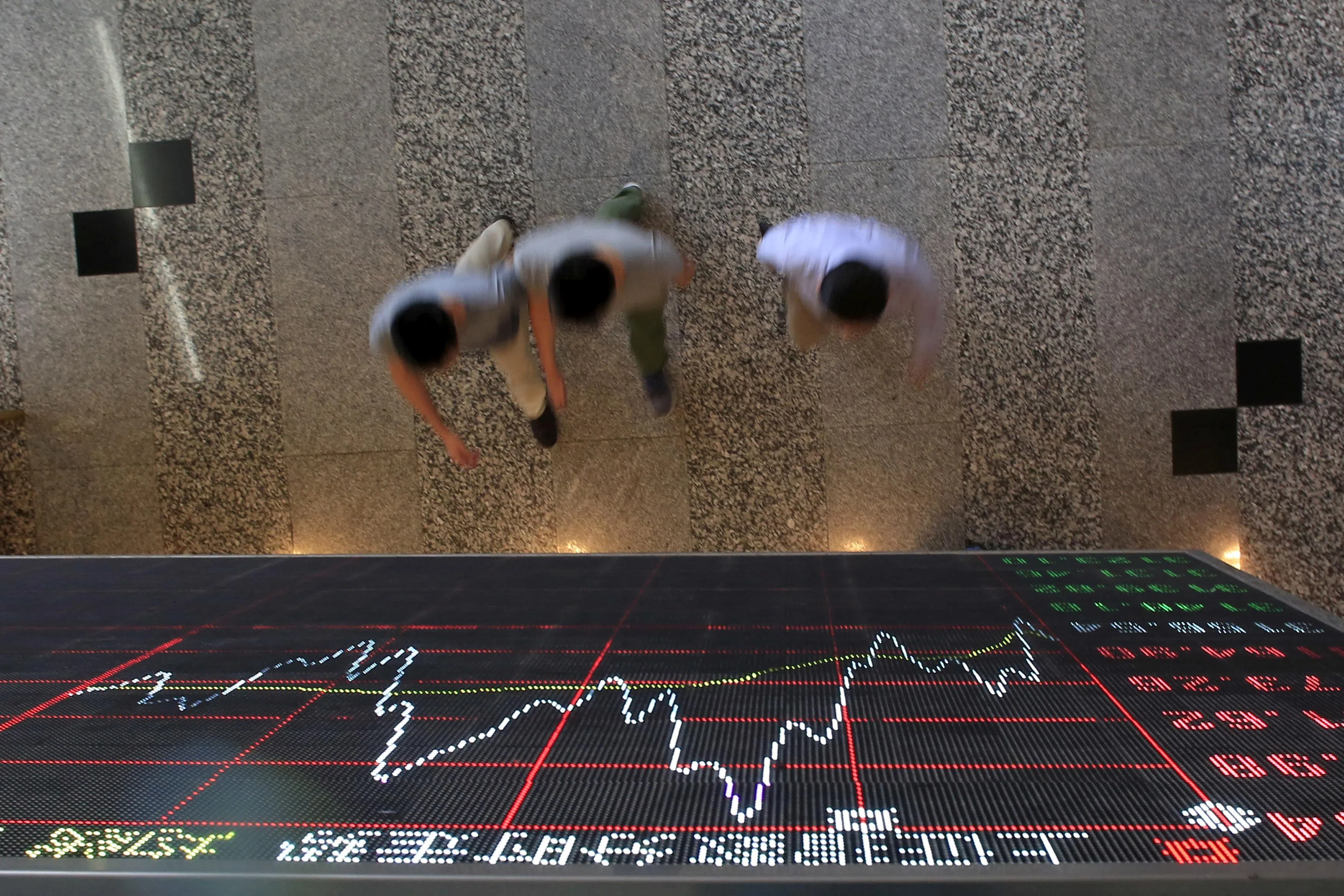

CHINESE investors are pouring money into two new exchange-traded funds (ETFs) tracking Saudi Arabian shares as the dismal performance of local equities supercharges demand for overseas assets.

The Saudi-focused ETFs enjoyed a bumper start when they debuted in Shanghai and Shenzhen on Jul 16 with both jumping by the daily 10 per cent limit on their first two trading days. They were then suspended for part of Jul 18 after their managers notified the exchanges that the premium of their share price over their net asset value had become excessive.

Part of the fervour surrounding the two ETFs is the growing economic and trading ties between China and Saudi Arabia. In recent months, companies and sovereign funds from both sides have announced a series of billion-dollar deals ranging from the tech industry to solar power and electric vehicles.

“Chinese investors are thirsty for better returns from overseas assets as the yield from China assets is too thin,” said Nelson Yan, co-chief investment officer at Fosun Wealth International in Hong Kong. “The relationship of China and Saudi Arabia is good, investment wise, and the geopolitics risk is smaller.”

Furthermore, Chinese high-level government entities “intend to lead investments to the Middle East, and we see Chinese index companies keen on developing Middle East-related indexes and ETFs”, he said.

Large premiums

The Huatai-PineBridge CSOP Saudi Arabia ETF QDII, which is listed in Shanghai, traded at a premium of as much as 17 per cent over its NAV on its second day of trading. The premium then shrunk back to 3.8 per cent on Jul 24, the latest date for which the information is available. The Shenzhen-listed China Southern Asset Management CSOP Saudi Arabia ETF QDII traded at a premium of 6 per cent on the same day. The vast majority of ETFs trade within 1 per cent of their NAV, according to website ETF.com.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

The current enthusiasm for Saudi Arabian shares is not the first time Chinese investors have become enamoured with a particular country’s equities.

In January, Chinese mutual fund houses tried to cool investors’ ardour for funds focused on US stocks, putting restrictions on their purchases of their products. In the same month, some fund companies were said to have allocated more Qualified Domestic Institutional Investor quotas to Japanese ETFs to bring their share prices closer to their NAVs.

While the Saudi market may appear more exotic to Chinese investors than Japanese or US shares, investors have been optimistic about ties between the two countries and are eager to know more, said Melody Xian He, deputy chief executive officer at CSOP Asset Management in Hong Kong.

‘Competitive advantage’

The two Saudi Arabian ETFs track the FTSE Saudi Arabia Index, in which the highest weightings are financials, basic materials and energy companies. Al Rajhi Bank, Saudi Aramco and Saudi National Bank account for nearly one-third of the gauge.

“The Saudi ETF index coverage corresponds to the current risk preference of domestic Chinese equity market investors,” said Ren YuChen, an investment adviser at Guotai Junan Securities. “The relatively high dividends from financial and resource stocks also give them a competitive advantage in dividend yields.” BLOOMBERG