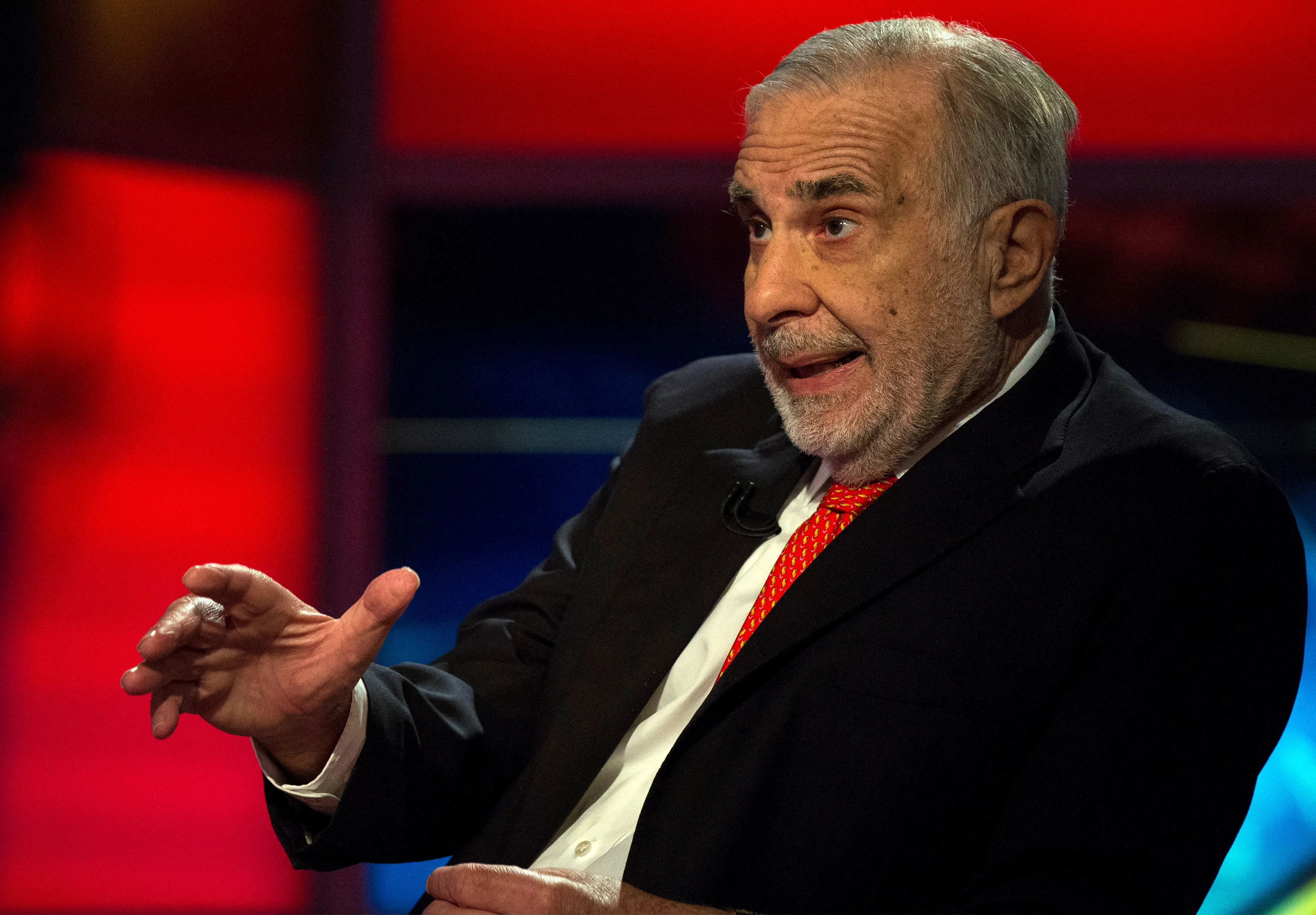

BILLIONAIRE investor Carl Icahn and his firm Icahn Enterprises LP (IEP) have settled charges that for years he failed to disclose pledging the majority of the firm’s securities for billions in personal margin loans, together agreeing to pay US$2 million in penalties, US regulators said on Monday (Aug 19).

The action came more than a year after short-seller Hindenburg Research accused Icahn of running a “Ponzi-like” scheme to pay dividends by over-valuing its holdings and also raised questions about Icahn’s margin borrowing.

Icahn said on Monday the outcome allowed him to put to rest the short-seller’s “scurrilous and unsupported” allegations as federal authorities had investigated Hindenburg’s claims but chosen not to take action.

However, Hindenburg said it stood by its allegations and continued its short position on the company’s securities.

Starting in 2018, Icahn pledged between 51 to 82 per cent of the IEP’s outstanding securities as collateral to secure billions of US dollars in personal margin loans from multiple lenders but did not disclose this until February 2022, the Securities and Exchange Commission (SEC) said.

The famed activist investor also allegedly failed to amend securities filings describing personal loans dating back as far as 2005, the agency said in a statement.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Had Icahn made the required market disclosures they “would have revealed that Icahn pledged over half of IEP’s outstanding shares at any given time,” Osman Nawaz, head of the Complex Financial Instruments Unit in the SEC’s Enforcement Division, said in the statement. This deprived investors of information they needed, he added.

Icahn and IEP neither admitted nor denied the SEC’s allegations. However, Icahn said Hindenburg’s report had used misinformation to boost its own financial position.

“After Hindenburg issued a false report to make money on its short position at the expense of ordinary investors, the government investigation that followed has resulted in this settlement which makes no claim IEP or I inflated” values or engaged in “a ‘Ponzi-like’ structure,” Icahn said in a statement.

IEP also revealed in a securities filing on Monday that it had had “no substantive communication” with federal prosecutors in Manhattan since officials there made an initial inquiry in May of last year.

IEP last year cut its dividend amid a steep decline in its share price driven by the short seller’s claims.

In a statement on the social media platform X, Hindenburg said on Monday’s developments had not disproved their accusations.

“The company is still operating a Ponzi-like structure, as we originally alleged,” the short seller said, adding that IEP continued to report losses while trading at an elevated premium. “We remain short units of US$IEP.” REUTERS