Weakness in Chinese equities is eroding the confidence of some of Wall Street’s staunchest supporters, with hopes for a turnaround fading in the world’s No 2 economy.

Over the past two weeks, longstanding China bulls UBS Global Wealth Management, Nomura and JPMorgan Chase & Co have all downgraded the country’s equities, citing concerns ranging from the property-led demand slump to piecemeal stimulus measures and geopolitical tensions ahead of the US elections.

The thinning patience with an increasingly elusive Chinese stock rebound has coincided with growing consensus among the world’s biggest banks that the country will fail to meet its growth target of around 5 per cent this year. The market weakness could also quicken a shift away from the China-centric model towards new favourites such as India, Taiwan and South-east Asia.

“I find this slew of downgrades to be like people throwing in the towel” on China equities, said Britney Lam, head of long-short equities at Magellan Investments. While light positioning may trigger a short-term rebound in China, Lam said she prefers Japan and India in the long run.

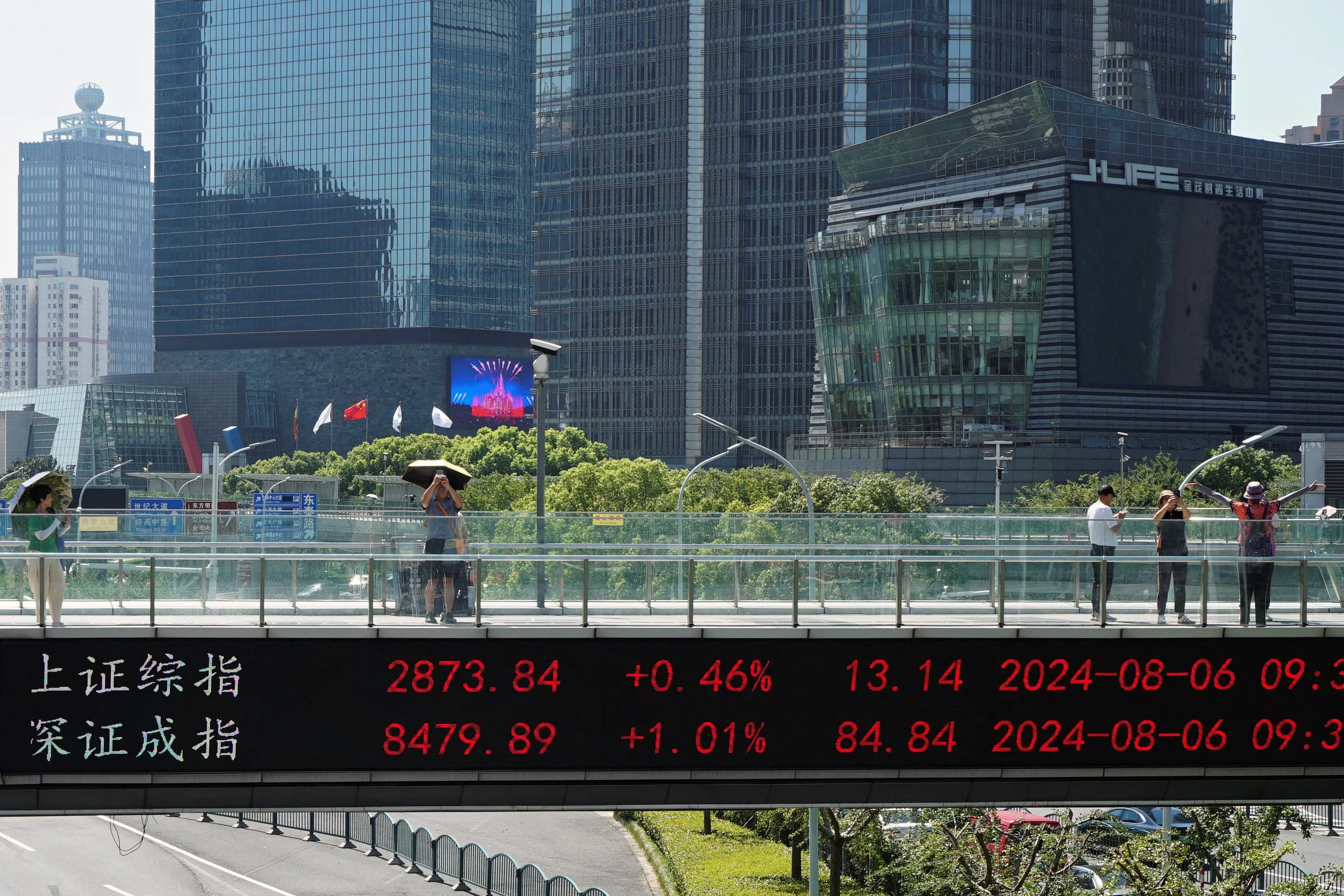

Down 5.8 per cent this year, the benchmark CSI 300 Index ranks among the world’s worst-performing major gauges and is heading for a record fourth year of losses. While hopes for improved corporate earnings and stronger policy support helped the index produce a 16 per cent rally between February and May, the gains have mostly evaporated after a dismal earnings season delivered a reality check.

Entrenched pessimism about China’s growth prospects is also evident in other markets. Yields on China’s 10-year sovereign note dropped to a fresh record this week while the 30-year bond yield extended declines past its near two-decade low. Iron ore futures are trading near 2022 levels, while the flight-to-safety investment flows were so heavy that risk premiums on Chinese local corporate debt reached their highest in a year.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Exclusion of the country’s stocks from global investment portfolios is also fuelling a retreat. New emerging-market equity funds launched this year that do not include the nation have already matched 2023’s full-year record of 19.

India has emerged as a favourite due to its vibrant economy, with Morgan Stanley citing that the nation’s weighting surpassing that of China’s in the MSCI Emerging Markets Investable Market Index should spur further foreign inflows.

“Since China’s current low inflation environment is conducive to global disinflation and rate cuts, other emerging markets will still benefit,” said Homin Lee, senior macro strategist at Lombard Odier Singapore. “Many managers will keep their focus on the booming emerging markets such as India and Taiwan for this reason, despite elevated valuations.”

Valuations may be one reason for opportunists to get back into China. The MSCI China Index is trading at less than nine times forward price-to-earnings, which makes the country’s stocks relatively cheap to investors willing to take on the risk.

“Whatever one may think of the government’s policies, China’s economy is here to stay,” Capital Group’s fund managers including Christopher Thomsen wrote in a note dated Aug 28. Value is emerging in industries such as Internet services, domestic leisure and travel, the electric vehicle supply chain and industrial automation, they added.

Still, that may do little for a broader recovery given the worsening earnings landscape. Both the CSI 300 and the Shanghai Composite Index have remained the worst performers on earnings outlook in Asia since at least April. Their 12-month forward earnings estimates have each fallen more than 9 per cent this year.

The latest slew of China trading recommendation downgrades are “prompting a reassessment of emerging market portfolios”, said Manish Bhargava, chief executive officer at Straits Investment Management in Singapore. “India is poised to benefit, given its robust economic growth and progressive reforms.” BLOOMBERG