Starbucks’ new chief executive Brian Niccol is facing a key test: convincing investors he’s worth the US$21 billion in market value the coffee chain notched after his appointment.

On Wednesday (Oct 30), during his first earnings call since taking the helm, Niccol needed to present a path out of the deepening sales slump that prompted the company last week to release preliminary earnings and yank guidance for the current fiscal year.

Niccol said the company needs to “fundamentally change” its strategy after promotions and product launches implemented by prior leadership didn’t work, sparking the chain’s third straight same-store sales decline. He’s expected to reveal more concrete details on Wednesday.

“He just has to get people to believe what he’s saying,” said Eric Gonzalez, analyst at KeyBanc Capital Markets. “I think he’s got all the benefit of the doubt right now.”

The company’s shares surged 25 per cent when Starbucks announced his hiring on Aug 13. Even so, the stock was up only 1.4 per cent this year through Wednesday’s close, compared to a 22 per cent rise for the S&P 500 Index.

Niccol, who engineered turnarounds at Taco Bell and Chipotle Mexican Grill, has acted quickly since taking the helm on Sep 9, starting with remaking the company’s top ranks. He hired a new global chief brand officer to “reintroduce” the brand to customers.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Ahead of the company’s call with analysts on Wednesday, Starbucks released a full earnings report that included expanded data for the fiscal fourth quarter, which ended Sep 29.

The CEO wants to refocus the company around Starbucks’ signature offering: coffee. Niccol said he wants to give baristas the time and tools they need and refine mobile ordering so it doesn’t overwhelm stores. He also vowed to simplify an “overly complex menu”. The chain is planning to pull its Oleato suite of olive oil drinks, in line with that strategy, Bloomberg News reported on Tuesday.

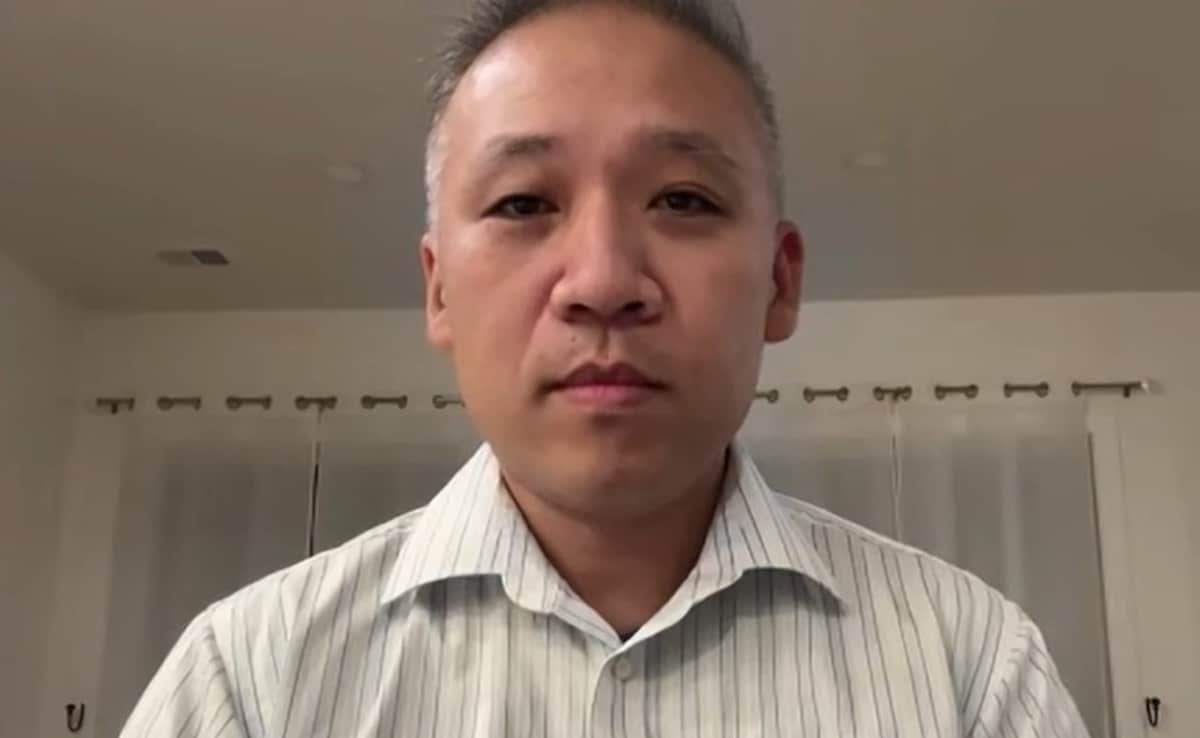

“I believe that our problems are very fixable,” Niccol said in a video posted to the Starbucks website on Oct 22.

He doubled down on the sentiment in the company’s Wednesday earnings release. “My experience tells me that when we get back to our core identity and consistently deliver a great experience, our customers will come back,” he said.

Any action on prices, which have become a point of contention for inflation-battered customers, will be in focus for investors. Niccol is also reviewing staffing, with only one-third of Starbucks store workers in the US saying it is sufficient.

Some investors are sceptical of Starbucks’ prospects, even with Niccol in charge. Dan Ahrens, portfolio manager of the AdvisorShares Restaurant ETF, said the exchange-traded fund removed the company from its holdings.

Among other topics, Ahrens wants to hear more about what Niccol’s plans mean for profits and how he’ll stoke growth in China, where the business has struggled given the country’s slow economic recovery and increasingly fierce local competition.

“Investors have heard a lot of mixed messages over the past couple years from Starbucks,” Ahrens said via email.

For KeyBanc’s Gonzalez, Niccol needs to answer the even bigger question of whether Starbucks is a growth company or a mature enterprise that will expand at modest rates.

“I just don’t know the answer to that question,” Gonzalez said. “That’s what I want to know before I can recommend a stock.” BLOOMBERG