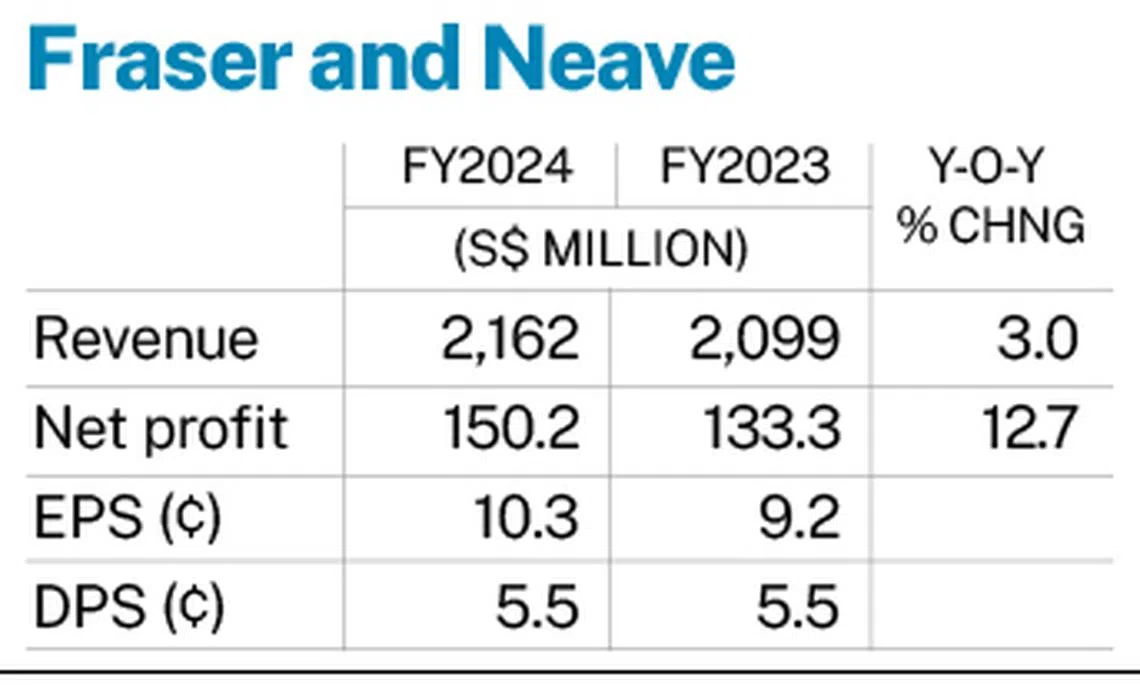

BEVERAGE and publishing company Fraser and Neave (F&N) on Friday (Nov 8) announced a 12.7 per cent rise in net profit to S$150.2 million for the financial year ended Sep 30, from S$133.3 million a year ago.

The group’s revenue grew 3 per cent to S$2.2 billion, from S$2.1 billion in FY2023.

This was largely driven by the strong performance of its food and beverage (F&B) segment, the revenue of which increased 4 per cent to S$1.9 billion, compared with S$1.8 billion in the previous year.

In particular, its beverages revenue rose on a favourable sales mix and higher volumes of beer and soft drinks from festive campaigns and new product launches.

However, its dairies revenue registered a modest 1 per cent growth to S$1.2 billion, which the group attributed to strong exports and domestic sales of canned milk across core markets. This was despite foreign exchange impacts, it added.

Meanwhile, revenue from its printing and publishing segment dropped 9 per cent to S$201.3 million, from S$221.4 million a year ago. F&N said this decline was largely due to reduced print orders and the closure of unprofitable business units.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Earnings per share stood at S$0.103 for the full year, up from S$0.092 cents the year before.

F&N’s board is recommending a final dividend of S$0.04 per share. Together with the interim dividend of S$0.015 paid out in June 2024, the total dividend for FY2024 amounts to S$0.055 cents, unchanged from last year.

The final dividend will be paid out on Feb 14, 2025, pending approval at the group’s annual general meeting on Jan 16.

Hui Choon Kit, chief executive officer of F&N, said that the group will continue to build on its momentum by expanding its market reach and enhancing its competitiveness through digital innovation.

“Through targeted investments and a deeper understanding of consumer preferences, we aim to strengthen our footprint in key markets and enhance operational efficiencies,” he said.

“Our ongoing commitment to harnessing data and technology will also play a crucial role in driving product innovation and elevating the customer experience.”

Shares of F&N closed flat at S$1.35 on Friday, before the release of the results.