SINGAPORE Gulf Bank is seeking to raise at least US$50 million in a funding round and plans to acquire a stablecoin payments company next year, according to people with direct knowledge of the matter.

The startup bank, established by Singapore family office Whampoa Group and licenced in Bahrain since February, is in talks with a Middle East sovereign wealth fund and other investors to sell an equity stake of less than 10 per cent by early 2025, the people said, asking not to be identified as the matter is private.

The proceeds will primarily go towards accelerating product development, enhancing the bank’s payment network and hiring more staff, the people said. The purchase of a stablecoin payments firm is planned for the first quarter in the Middle East or Europe, they said. A spokesperson for the bank declined to comment on the fundraising, valuation or acquisition plans.

Optimism about the digital-asset sector is growing, helped by the promise of supportive industry regulations in the US under President-elect Donald Trump. The value of the crypto market has climbed by about US$1 trillion since Trump’s victory in the election on Nov 5, and some commentators expect a pickup in deal-making to ensue in coming months.

Stablecoin usage

Stablecoins are crypto tokens pegged to fiat currencies, usually the US dollar. Their value is typically underpinned by reserves of cash and bonds. Interest in this corner of digital assets is expanding as stablecoins offer speed, cost and accessibility advantages over some regular banking payment rails.

A range of jurisdictions globally are striving to develop crypto hubs that both protect investors and prove attractive to companies specialising in blockchain-based technology and services. Bahrain, Dubai and Abu Dhabi are among the Middle Eastern centres vying to woo businesses.

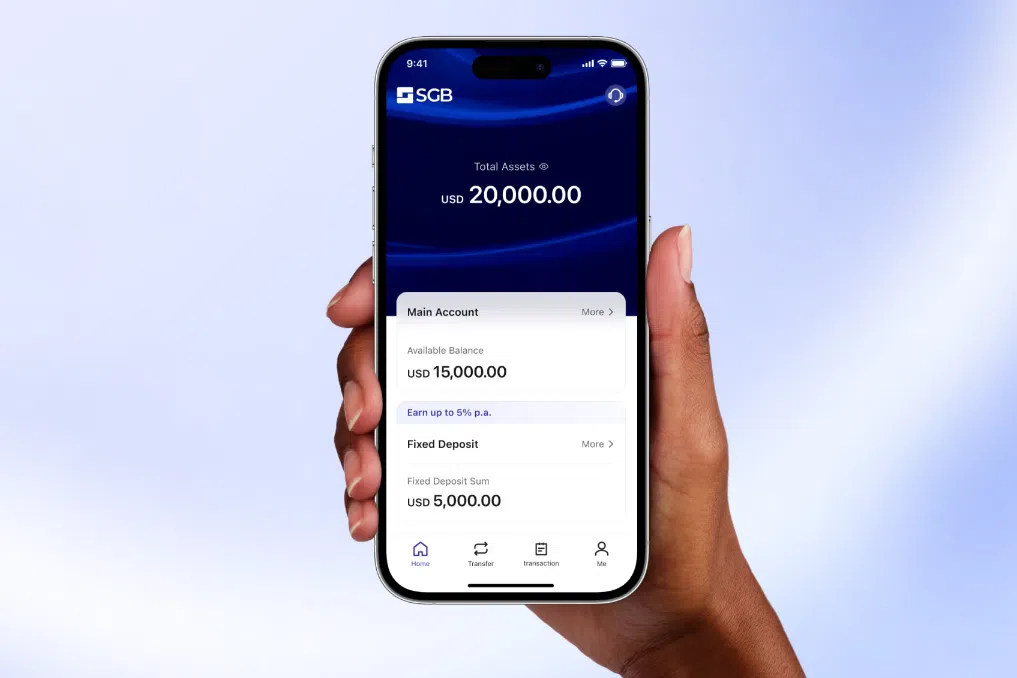

Singapore Gulf Bank allows companies to manage traditional financial and digital assets on a single platform and plans to extend the service to individuals by the end of this year. The bank is backed by sovereign wealth fund Bahrain Mumtalakat Holding as well as Whampoa Group.

Crypto businesses have sometimes struggled to access the banking sector because of the industry’s volatility and history of scandals. The icy reception is thawing as more and more financial centres roll out dedicated rulebooks. BLOOMBERG