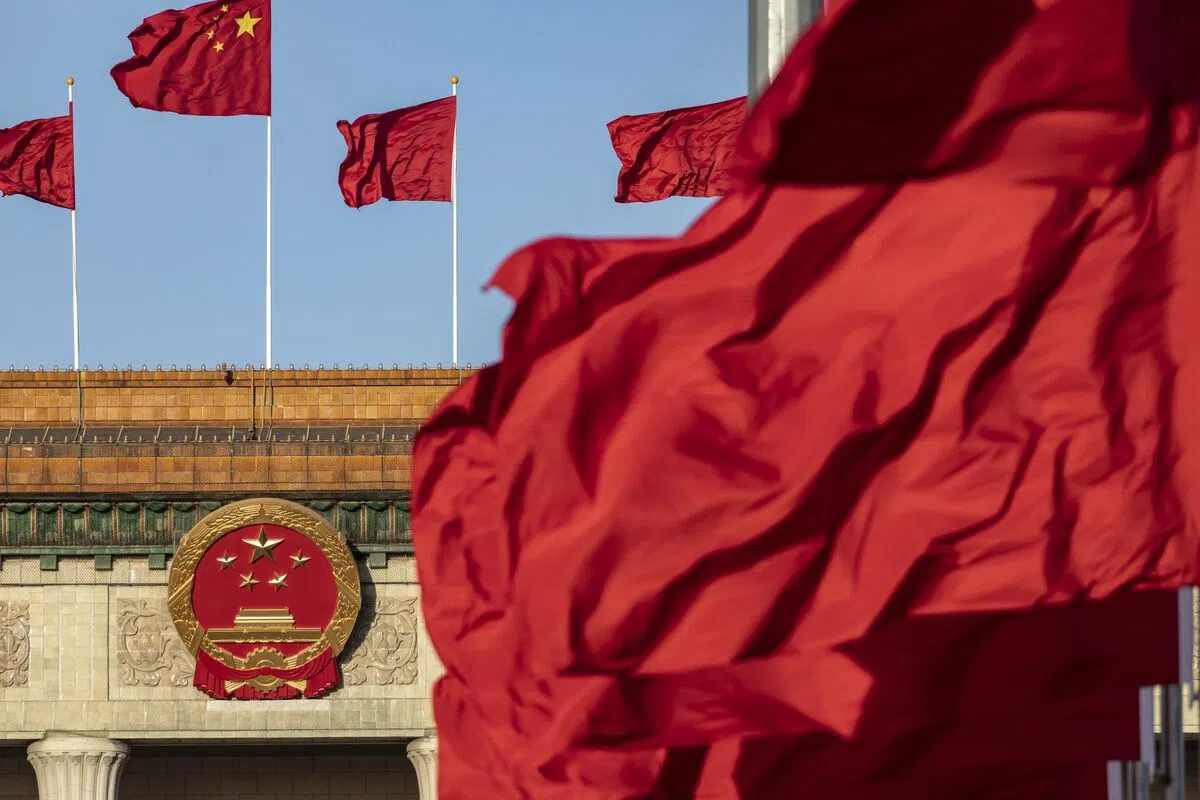

EMERGING-market currencies in Asia and the South African rand retreated as China’s policy makers appeared to disappoint investors expecting fiscal measures to boost the economic outlook.

The EM currency index fell for the third day, with the Thai baht, South African rand and the Indonesian rupiah leading the losses on Friday (Dec 13). China 10-year yields fell to a fresh low as the government signalled more easing, and Chinese equities were in the red on Friday, driving benchmark EM indices lower as well. The MSCI EM equity index also fell 0.5 per cent to pare this week’s gains to 0.2 per cent, which would be the second week of gains.

Emerging-market sentiment was subdued after China’s Central Economic Work Conference ended without policy details on fiscal stimulus, even as authorities pledged to boost consumption. Traders have watched data and measures from China as the market is affected by its size and trading relationships with other developing countries. The nation’s benchmark yields fell to a fresh low as investors continue to expect monetary policy to do most of the legwork for now.

“These broader FX moves are being driven by China spillovers – headlines this morning are pointing to weak growth yet again, and that is weighing on currencies sensitive to Chinese demand,” said Nick Rees, an analyst at Monex Europe. “Given scepticism around the reliability of official statistics, even measures that would ordinarily be supportive are not in China, with markets more inclined to take their steer from the policy response as to the state of the underlying economy.”

The pessimism concerning China and emerging markets has been exacerbated as Donald Trump’s election in November reignited US dollar and stock market gains, as well as putting the focus on potential new US trade tariffs. “We are bearish on EMFX next year, expecting everything to get steamrollered by the US dollar,” said Rees. “But by how much, that will depend on the specifics of Trump tariffs, and we are still waiting for clarity right now.”

Indonesian intervention

The rupiah also weakened against the greenback as Bank Indonesia signalled that it was intervening to support the local currency. The won edged lower against the US dollar for a second day as traders await the results of another impeachment vote against President Yoon Suk-yeol expected on Saturday.

The direction of the yuan is clear but the magnitude of depreciation is down to China’s policy makers, said Mark Ledger-Evans, a portfolio manager at Ninety One. “Allowing the currency to weaken too much may work against EMs,” he said.

One dose of optimism for stock investors came from weekly flows data showing EM stocks had a second week of inflows at US$3.4 billion, while EM debt had an eighth week of outflows at US$1.1 billion in the week to Dec 11, according to a BofA note citing EPFR Global data. BLOOMBERG