FOR a third year in a row, trading of derivatives in Hong Kong has hit a record.

More than 377 million futures and options have changed hands on the city’s bourse since January, up 14 per cent from 2023, data from Hong Kong Exchanges and Clearing (HKEX) show. That happened as stock-volatility gauges hit their highest levels in more than two years in October.

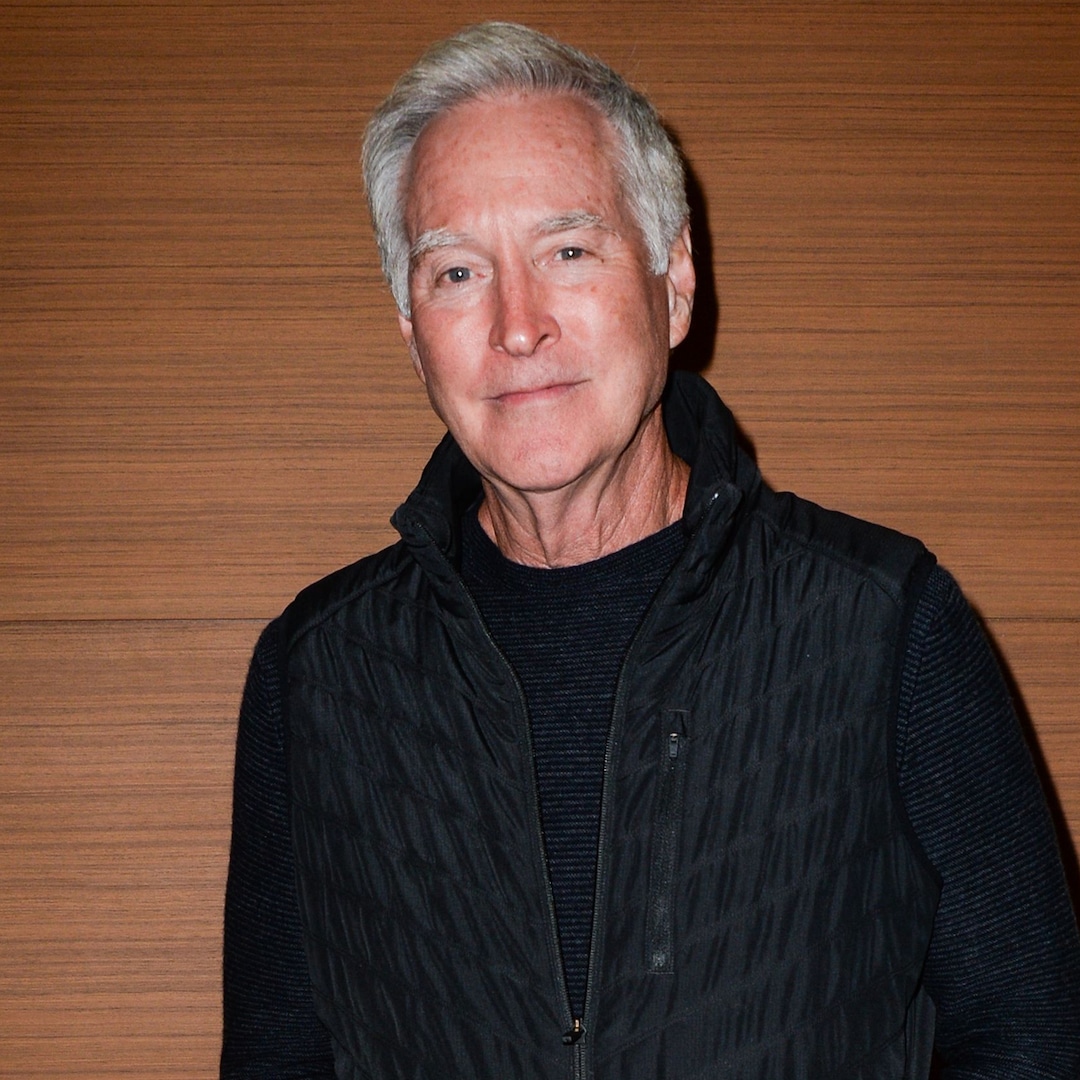

China’s pledge to revive its economy initially spurred a wave of euphoria among traders, but that quickly waned with the government’s slow pace of implementation. Equity gyrations jumped as trading of shares hit levels never seen before, increasing the need to hedge. Some investors used derivatives to bet on the market in a cautious way, according to Societe Generale’s Frank Benzimra.

“In that case, it’s very much on the options market that you can express some views,” the strategist said at a briefing on Thursday (Dec 19).

China’s stimulus bazooka – which included interest-rate cuts, cash for banks and support for equities – made the once-beaten shares from Hong Kong and the mainland some of the world’s best for the year, before the easing of optimism triggered a rush to sell. Overall, daily stock turnover rose by more than one-fifth for Hong Kong and China from 2023, data compiled by Bloomberg show.

That helped spur the local derivatives market. With a few days remaining to the end of the year, options volume in Hong Kong increased 15 per cent from 2023 to 209 million contracts to Friday, while that of futures climbed 13 per cent to 168 million, HKEX data show.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

The bourse itself has boosted efforts to grow the market. It launched weekly options on the Hang Seng Tech Index in September and on 10 single stocks – including HSBC Holdings, Tencent Holdings and Alibaba Group Holding – in November. In their first month of trading, the weekly versions accounted for more than 10 per cent of the total contracts volume for most of the companies.

“There is growing demand for shorter-dated options, and the new single-stock weekly products in particular have shown quite an impressive start,” said Joey Colebatch, head of equity options at Optiver in Sydney. “We expect the trend to continue into next year and anticipate the offering to expand to further underlyings.”

In the US, where an average of 48 million options change hands each day on average, contracts volume reached 11.2 billion in 2024, a fifth year of records, Options Clearing data show. The introduction by Cboe Global Markets of weeklies in 2005 and of daily options in 2022 has helped boost trading, and contracts expiring in less than a week now account for more than half of the volume.

While the growing suite of derivatives available in Hong Kong increased the appeal of the instruments, the surge in optimism over the Chinese market also led to an unusual situation in 2024: The gauges of swings for the Hang Seng Index and Hang Seng China Enterprises Index moved in the same direction as their equity counterparts on more than half of the days since January – higher than on any previous year. In the US, the Cboe Volatility Index and S&P 500 Index fluctuate in opposite ways about 80 per cent of the time, and it can be a warning sign when they do not.

But in Asia, traders chasing the rally this year bought up bullish options, leading to a jump in volatility, according to Wei Li, head of multi-asset investments for China at BNP Paribas. The move was especially pronounced because demand for calls came suddenly, after investors had been shunning Chinese equities for several years.

“It actually created a problem of supply and demand imbalance in volatility,” Wei said, adding that he expects a further rally in Hong Kong stocks. “When there is an equity rally, there will be strong demand from investors for derivatives.” BLOOMBERG