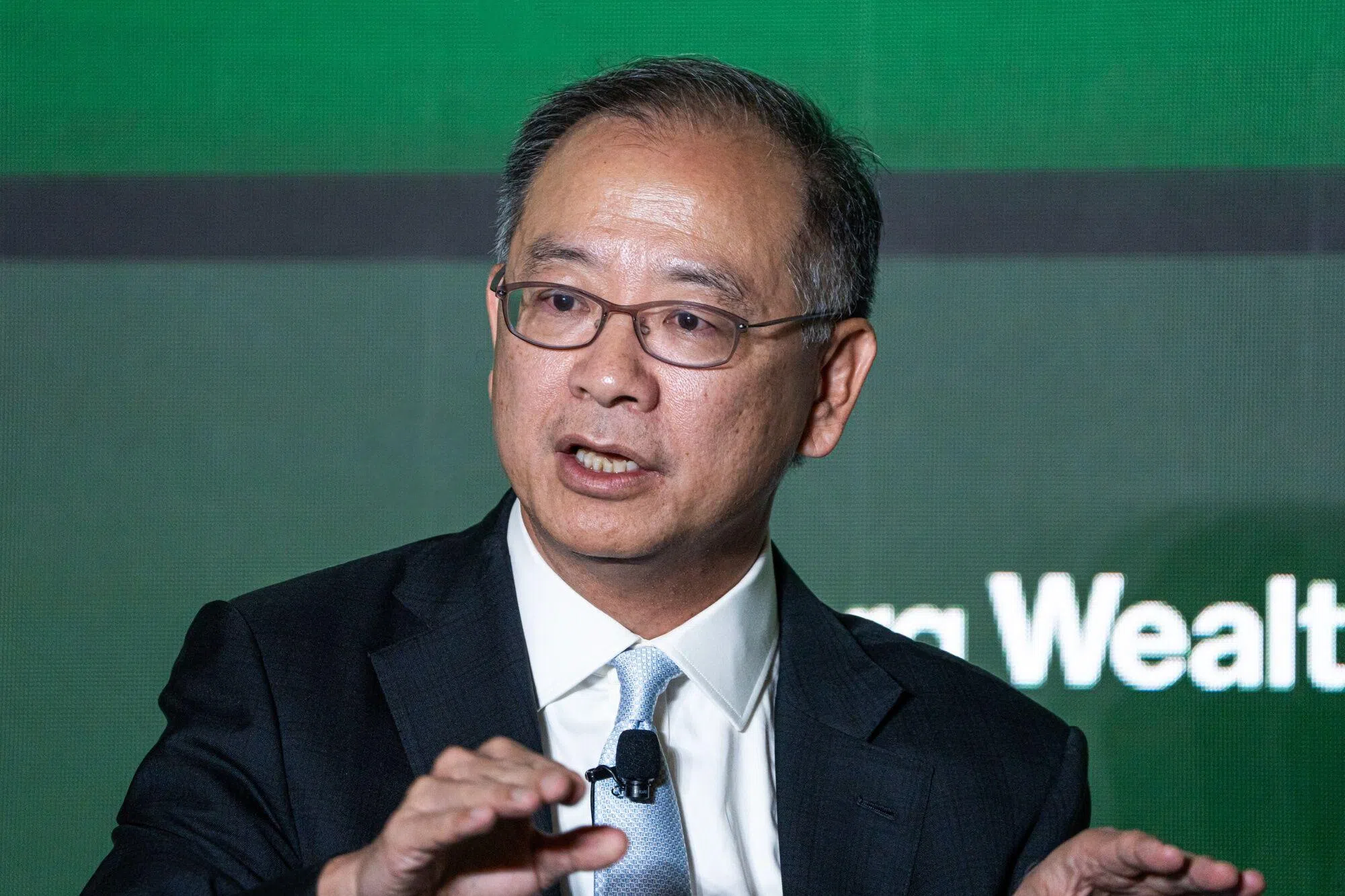

PHILIPPINE Finance Secretary Ralph Recto said the nation’s central bank will continue to deliver interest rate cuts this year, but they may be fewer and farther apart than in 2024 in the face of geopolitical tensions and uncertainties from US policies.

The government will return to the global debt market most likely in the first half to start raising the US$3.5 billion foreign bond sale it plans for 2025, Recto told Bloomberg Television’s Haslinda Amin on Monday (Jan 20) on the sidelines of the World Economic Forum in Davos. The government is in talks with eight banks to help with debt sale, which will be mostly denominated in US dollar, he said.

“There’s uncertainty on what he plans to do with regards to tariffs and inflation,” according to Recto, referring to the US president hours before Donald Trump took office and said that the US will “tariff and tax” other countries while sidestepping specific details.

The Philippines is unlikely to be directly hit by any Trump levies, yet they could lead to higher prices globally that could fan inflation and hold back policy easing, the finance secretary said. This is why Recto, who sits in the central bank’s Monetary Board, said he’s only looking at a total of 50 to 75 basis points in key rate reductions this year and staggered as far apart as 25 basis points per semester.

As Trump starts his second term after promising steep tariffs and strict immigration policies during the campaign, governments all over are trying to spell out how their economies will be affected.

Trump held off unveiling China-specific tariffs on his first day and instead ordered his administration to address unfair trade practices and investigate China’s compliance with a previous deal. The US dollar fell, boosting foreign currencies, as traders bet that Trump would not implement aggressive tariffs immediately.

A NEWSLETTER FOR YOU

Friday, 8.30 am

Asean Business

Business insights centering on South-east Asia’s fast-growing economies.

The peso, which has weakened by about 1 per cent against the US dollar so far this year and is among the worst performers in the region, opened 0.3 per cent stronger against the US dollar on Tuesday in Manila.

“If tariffs are imposed and inflation goes up, then interest rates may not go down as much as we want it to, right? So that would affect global growth,” Recto said, adding that he considers global uncertainty and geopolitical tensions as among the biggest risks.

Borrowing costs in the Philippines have remained elevated even after a total of 75 basis points in rate cuts from August to December last year. The finance chief said ample remittances from overseas workers and other US dollar sources ease the pressure to raise more foreign funding.

About US$1.5 billion in dollar bonds will be due in March and 785 million euros in euro-denominated debt in April, according to data compiled by Bloomberg. Last year, the Philippines sold about US$4.5 billion in international bonds.

“There’s a lot of domestic savings in the Philippines so there’s a lot of liquidity,” Recto said. The South-east Asian nation is expected to grow at least 6 per cent this year, said the finance secretary who expects the country to remain resilient amid the risks. Robust household consumption will continue to drive growth, he said.

The finance chief also said that the current peso level is “okay” as it’s moving in line with other currencies that have also weakened due to a strong US dollar. Authorities intervene in the currency market only when it’s volatile, he added.

“In the Philippines, we are not so much concerned about where the peso will be going. Let the market forces determine that,” he said. BLOOMBERG