SABANA Industrial Real Estate Investment Trust (Reit) posted a distribution per unit (DPU) of S$0.0152 for the half-year ended Dec 31, 2024, up 32.2 per cent from S$0.0115 in the year-ago period.

The increase came even as about 10 per cent of total income available for distribution in FY2024 was retained for “prudent capital management”, in view of additional costs incurred and to be incurred during the internalisation of the Reit manager, according to a bourse filing on Tuesday (Jan 21).

Further retention of distributable income may be required for FY2025, it said.

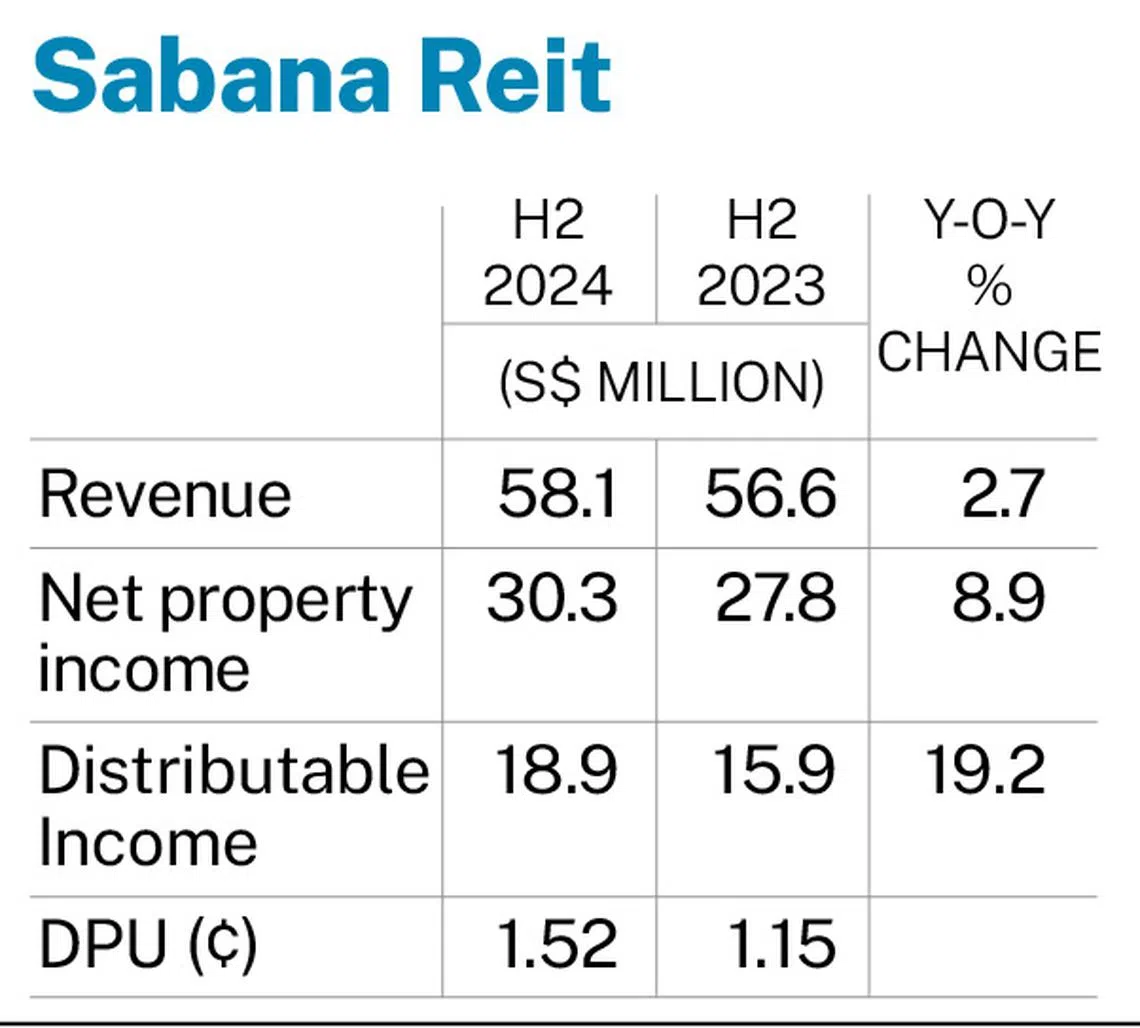

Revenue for H2 2024 rose 2.7 per cent year on year (yoy) to S$58.1 million, from S$56.6 million previously, lifted by strong positive rental reversions across the portfolio.

Net property income (NPI) grew 8.9 per cent yoy for the half-year to S$30.3 million, from S$27.8 million, which was mainly attributed to higher revenue and lower overall property expenses.

“The manager achieved a four-year high positive rental reversion in FY2024, while its positive rental reversion in Q4 2024 marks its 16th consecutive quarter of positive rental reversion since Q1 2021,” the filing said.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Total income available for distribution in H2 2024 came in at S$18.9 million, up 19.2 per cent from S$15.9 million in the corresponding year-ago period.

The second half’s results bring the DPU declared for FY2024 to S$0.0286, a 3.6 per cent increase from S$0.0276 in FY2023.

For the full year, income available for distribution was up 5.5 per cent to S$35.6 million.

The Reit attained an all-time high revenue of S$113.3 million in FY2024 – an increase of 1.3 per cent yoy – since its initial public offering in November 2010, its manager said.

It also achieved a new high in NPI of S$57.5 million since 2016, despite a smaller portfolio, it added. This marked an expansion of 4.5 per cent from the year-ago period.

Overall portfolio occupancy rate slipped to 85 per cent as Dec 31, 2024, from 91.2 per cent the year before, mainly due to the repossessions of 33, 33A and 35 Penjuru Lane in March 2024 and subsequently, 30 and 32 Tuas Avenue 8 in June.

Donald Han, CEO of the Reit’s manager, said: “Despite the uncertainties that the internalisation process brought along, we pressed on to safeguard the financial prudence of the Reit to maintain the foundation for stability.”

In June 2023, activist investor Quarz Capital requisitioned an extraordinary general meeting to pass two resolutions: to remove Sabana Reit’s manager, and to direct the trustee to internalise the Reit’s management function.

For FY2024, S$6.8 million of expenses were incurred in respect of the implementation of the resolutions passed on Aug 7, 2023, to effect the internalisation. Cumulatively, internalisation expenses incurred up to the end of FY2024 totalled S$11.4 million.

Singapore’s economic growth is expected at close to its potential rate in 2025, but uncertainty remains, the manager said.

Citing research from Savills Research and Cushman & Wakefield, it noted expected surges in industrial space and business park supply will put pressure on occupancy and rents.

The manager expects 2025 to be challenging for Sabana Reit. This is amid rising cost pressures, exacerbated by the prospect of interest rates remaining at elevated levels as the US Federal Reserve hold rates for an extended period, and geopolitical conflicts, that in turn are expected to impact both the global and Singapore economy.

Units of Sabana Reit closed at S$0.375 on Tuesday, up S$0.005 or 1.4 per cent, before the announcement.