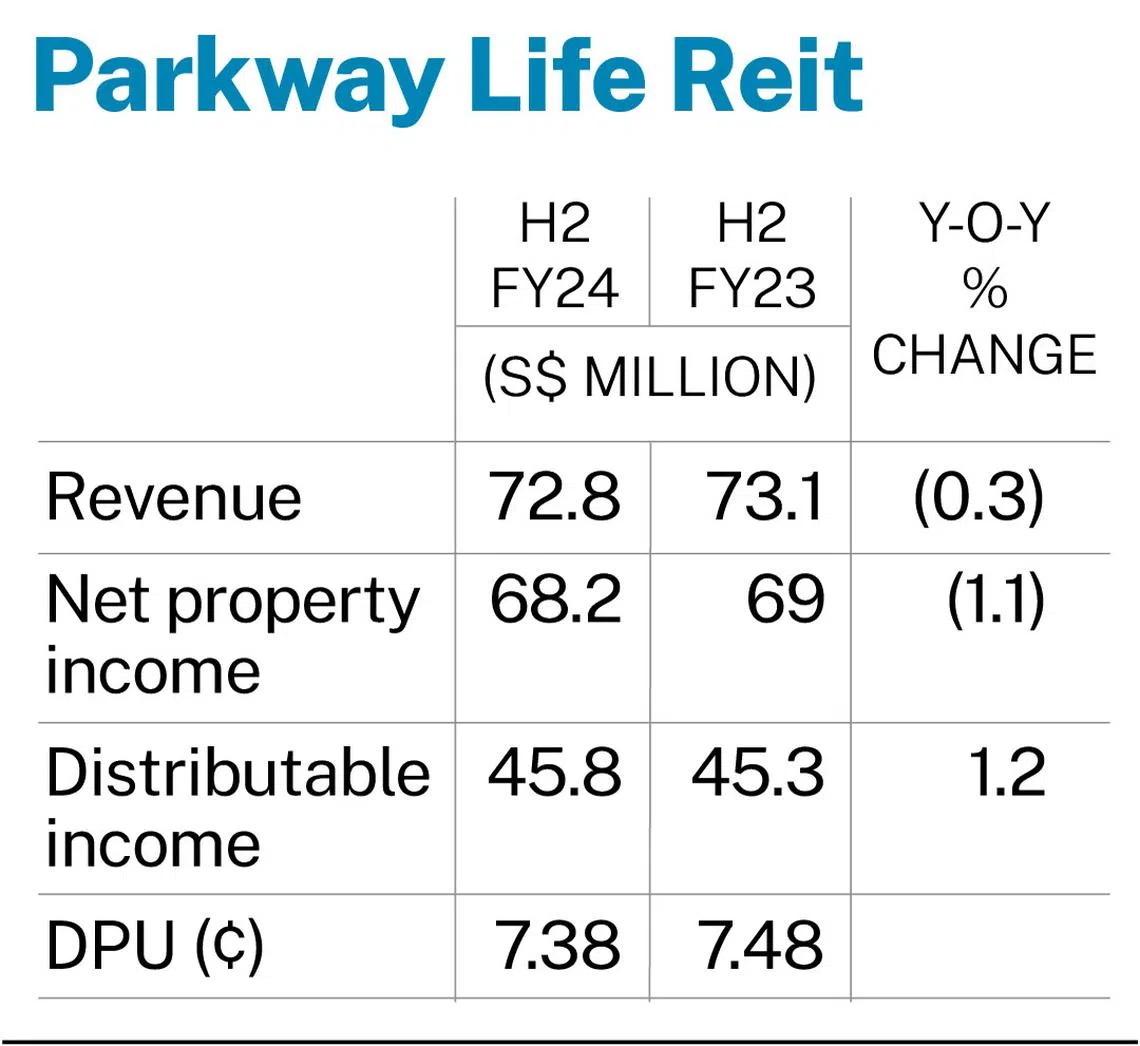

THE distribution per unit (DPU) of (Reit) for the second half ended Dec 31, 2024, was S$0.0738, sliding 1.3 per cent from S$0.0748 in the corresponding year-ago period, said its manager in a bourse filing on Wednesday (Feb 5).

This fall comes amid the healthcare Reit’s enlarged unit base, following the issuance of 47.4 million units last November from an equity fundraising exercise.

The H2 DPU includes an advanced DPU of S$0.05 for the period Jul 1 to Oct 31, 2024, which was distributed on Nov 26 last year. The remaining amount will be paid on Mar 11.

Distributable income for H2 FY2024 rose 1.2 per cent to S$45.8 million, from S$45.3 million in H2 FY2023.

Revenue for the half-year ticked down 0.3 per cent on year to S$72.8 million, from S$73.1 million. This was attributed to the depreciation of the Japanese yen, but partially offset by the contribution from two nursing homes acquired in October 2023, one in August 2024, and 11 in December 2024.

Correspondingly, net property income for the six months fell 1.1 per cent to S$68.2 million, from S$69 million year on year.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

On an annualised basis, H2 distribution yield was 3.94 per cent, based on the closing market price of S$3.75 as at Dec 31, 2024.

For the full year, FY2024’s DPU was S$0.1492, 1 per cent higher than FY2023 DPU of S$0.1477. The manager attributed this gain to a resilient portfolio and disciplined capital management.

Excluding the enlarged unit base, DPU for FY2024 would have been S$0.1511, 2.3 per cent higher than S$0.1477.

Distributable income for the year came in at S$91.4 million, climbing 2.3 per cent from S$89.3 million.

Revenue for the 12 months slid 1.5 per cent to S$145.3 million, from S$147.5 million.

Net property income for the full year also declined, down 1.8 per cent at S$136.6 million, from S$139.1 million for FY2023.

Distribution yield for the full year was 3.98 per cent, based on the S$3.75 closing market price as at Dec 31, 2024.

As at the latest appraised values, the Reit’s asset portfolio is worth close to S$2.5 billion.

As at Dec 31, 2024, the Reit had achieved a portfolio valuation gain of S$97.2 million compared to the last valuation, and an increase of S$6 million compared to net book value.

The valuation gain was primarily driven by projected rent increase for its Singapore hospitals and partly offset by the capex on Mount Elizabeth Hospital, and capitalised costs of its acquisition in France.

The manager said the Reit is maintaining a “healthy” gearing ratio of 34.8 per cent, and does not have long-term debt refinancing needs until September 2026.

It added that it is employing “effective hedging techniques” to maintain financial stability. For example, the Reit is mitigating income foreign exchange risks through Japanese yen net income hedges, which are in place until the first quarter of 2029.

Units of Parkway Life Reit gained 1.5 per cent or S$0.06 to S$3.94 on Wednesday, before the announcement.