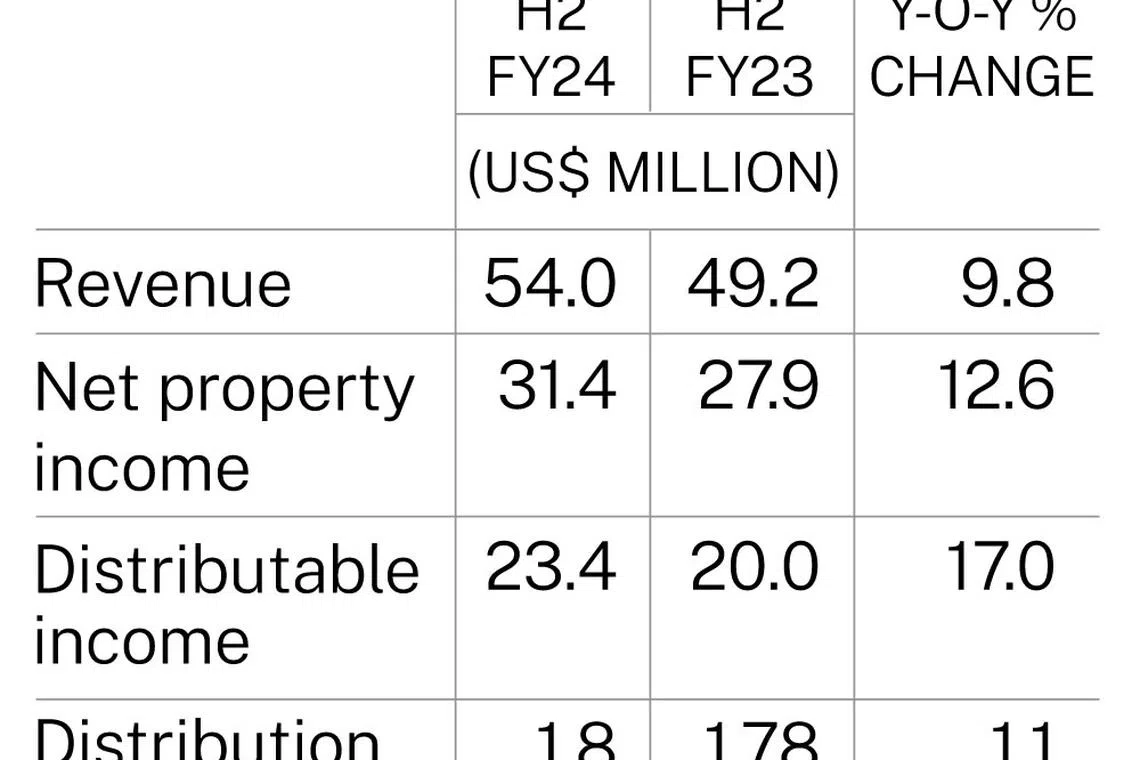

DIGITAL Core Real Estate Investment Trust (Reit) posted a distribution per unit (DPU) of US$0.018 for the six months ended Dec 31, 2024, up 1.1 per cent from the year-ago period.

The data centre-focused Reit’s revenue for the half-year was up 9.8 per cent year on year at US$54 million; its net property income (NPI) rose 12.6 per cent to US$31.4 million.

Distributable income to unitholders grew 17 per cent to US$23.4 million over the same period.

The Reit manager on Wednesday (Feb 12) said the growth in revenue came largely from straight-line rent written off due to a customer bankruptcy in H2 2023.

Cyxtera Technologies, a global co-location and interconnection provider, filed for bankruptcy protection in June 2023. To resolve this, Digital Core Reit entered an agreement with Brookfield Infrastructure Partners to divest some of its Silicon Valley assets for US$160 million.

The decrease in rental income from the divestment was offset by higher co-location income from two of the Reit’s Los Angeles assets – 3015 Winona and 200 North Nash – as well as additional income from its Frankfurt facility, which became a subsidiary in December 2024.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Finance income grew 66.2 per cent to US$5 million, from US$3 million in H2 2023, due partly to higher fixed deposits placed with banks.

Net fair-value gain in investment properties was US$251.6 million, reversing a loss of US$139.2 in the prior corresponding period. This was attributed to the Reit’s North American portfolio notching an 11 per cent gain of around US$135.7 million, on the back of positive market fundamentals and a combination of new and extended lease executions.

For the full year, Digital Core Reit posted a 2.7 per cent fall in DPU to US$0.036. FY2024 revenue was down 0.3 per cent at US$102.3 million, while NPI declined 1.9 per cent to US$61.8 million.

As at Dec 31, the trust had US$1.6 billion in assets under management, mostly in core data centre markets across the US, Canada, Germany and Japan.

New and renewal leases represented US$74 million of annualised rental revenue, while the cash rental rate reversion on renewal leases was 4.3 per cent.

Portfolio occupancy was 96.7 per cent, with weighted average lease expiration at 4.8 years.

Units of Digital Core Reit closed up 1 per cent or US$0.005 at US$0.515 on Wednesday, before the results were released.