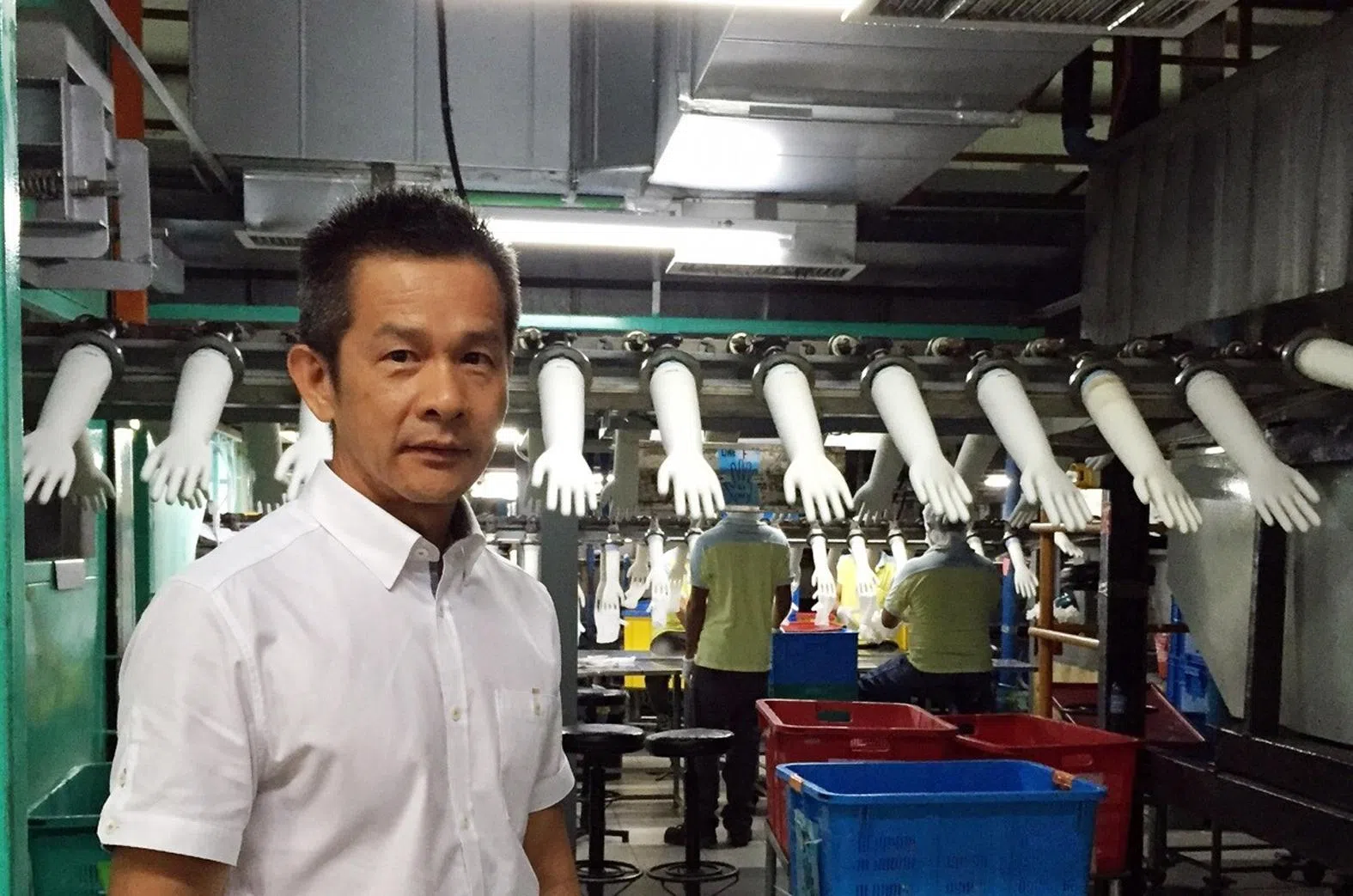

GLOVEMAKER Riverstone posted a 3.7 per cent rise in net profit to RM70 million (S$21.2 million) for the three months ended December 2024, as it rode optimism in the semiconductor industry.

Its revenue for the quarter rose 21 per cent to RM278 million, bringing its FY2024 revenue to RM1.1 billion. The company’s full-year profit likewise rose, by 30.2 per cent to RM286.9 million.

The revenue growth was driven by the cleanroom glove segment, which benefited from recovery in the semiconductor industry, as well as new client acquisitions.

Efforts to add new cleanroom clients “would bring in additional revenue streams upon the completion of the qualification process in the near future”, said Riverstone chief executive Wong Teek Son in a press release on Friday (Feb 21).

The company’s healthcare glove segment also improved with the “normalisation” of post-pandemic inventory.

Its FY2024 gross profit margin expanded 4.1 percentage points to 36.4 per cent, driven by efforts to move its product mix towards high-end customised products.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

In view of “healthy operating cash flow”, Riverstone declared a final dividend of RM0.08 per share, as well as a special interim dividend of RM0.04 per share. Combined with an earlier payout of RM0.12, the total dividend for FY2024 is RM0.24 per share, payable at a date to be determined.

Wong noted that Riverstone has phased out some of its ageing production lines and replaced them with more efficient ones. He said: “These new lines are designed to support smaller batch volumes with greater customisation, progressively transforming the group’s product mix from a generic product dominance to more speciality solutions with better profitability.”

That said, the company is also facing challenges such as “price competition, currency fluctuations, volatile raw material prices, and increased production costs”, it said in its earnings statement.

Riverstone shares ended Friday at S$1, up 2.6 per cent.