EUROPEAN commercial property deals rebounded in 2024 after two years of contraction, with MSCI data showing a busy fourth quarter with a transaction value totalling 55.6 billion euros (S$80.3 billion), an 11 per cent increase year on year. While the United Kingdom, Sweden, and the Netherlands showed positive trends, France and Germany had mixed results.

This recovery is supported by a significant inward shift in prime yields across various sectors, particularly logistics and offices, indicating strong demand and investor confidence.

A survey by the European Association for Investors in Non-Listed Real Estate Vehicles indicates that real estate investors’ top preferences for 2025 are residential, industrial, and student accommodation, reflecting a continued focus on sectors with robust fundamentals and growth potential.

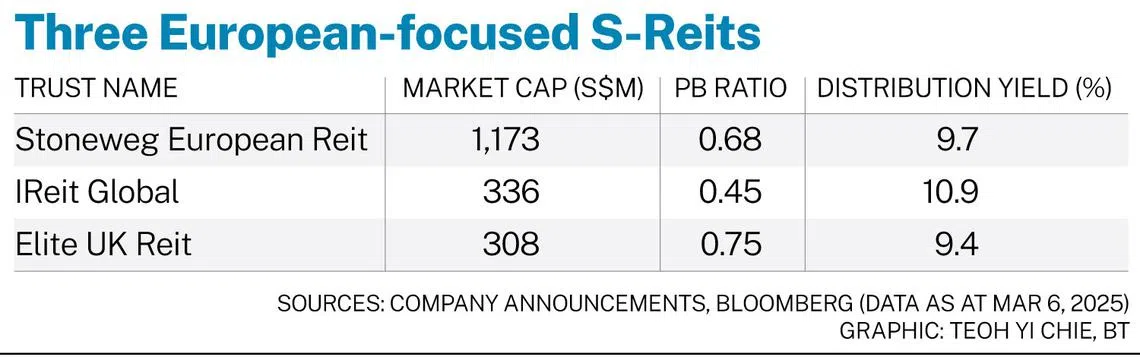

There are three Singapore-listed real estate investment trusts (S-Reits) that are Europe-focused – Elite UK Reit, IReit Global, and Stoneweg European Reit.

Elite UK Reit’s revenue and net property income (NPI) for the 2024 financial year decreased by 1.2 per cent and 10.3 per cent year on year, respectively.

However, distribution per unit (DPU) rose 5 per cent to 2.87 pence due to interest and tax savings. The Reit’s portfolio valuation increased to £416.2 million (S$715 million) as at Dec 31, with its occupancy rate improving by 160 basis points to 93.9 per cent.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

IReit Global’s FY2024 revenue and NPI increased by 16.3 per cent and 7.2 per cent year on year, respectively, driven by the B&M portfolio and higher rents from the Decathlon portfolio and Berlin Campus.

The Reit’s DPU rose by 1.6 per cent to 1.90 euro cents. IReit’s manager plans to reposition Berlin Campus into a mixed-use, multi-let asset and has secured two major hospitality leases for this project.

Stoneweg European Reit (Sert) reported lower FY2024 revenue and NPI of 1.6 per cent and 2.3 per cent on year, respectively. DPU declined by 10.1 per cent to 14.106 euro cents, mainly due to asset sales and higher interest costs.

In December 2024, Sert was renamed from Cromwell European Reit after welcoming its new sponsor Stoneweg Icona Capital Platform (Stoneweg). Stoneweg, a global alternative investment group headquartered in Geneva, Switzerland, manages approximately 10 billion euros in assets, employs more than 300 professionals, and operates in 15 European countries, the US, and Singapore. Stoneweg is also a 28 per cent substantial unitholder of Sert.

The new sponsor is expected to bring complementary expertise, footprints, and an extended financial network in Europe, and Sert has a right of first refusal over its sponsor’s investments. The larger integrated platform is expected to offer expanded opportunities, such as logistics and data centre projects and potential new markets in Switzerland and Spain.

In 2021, Sert accelerated its pivot towards logistics assets with its first acquisition in the United Kingdom. It now has 55 per cent of its portfolio comprising logistics and light industrial assets for future value creation, and noted that it is on track to reach 60 per cent.

The Reit’s logistics and light industrial portfolio remains resilient at 94.2 per cent occupancy and a 5 per cent rent reversion in FY2024. Sert noted that this segment of its portfolio is under-rented with passing rents still 7.2 per cent lower than market rents.

It added that it continues to be a beneficiary of the still-growing e-commerce penetration, with European online parcel delivery forecast by Cushman & Wakefield to grow by 37 per cent between 2022 and 2027.

The Reit’s logistics and light industrial valuations rose 4.5 per cent year on year in FY2024, underpinning the 0.8 per cent increase in its overall portfolio valuation.

On the capital management front, Sert said that its financial position has significantly improved following its recent six-year 500-million-euro green bond issuance, which was almost five times oversubscribed.

On the sustainability front, its strategy is to continue focusing on modern offices that have environmental, social and governance certifications and are well-located. Its Nervesa 21 in Milan completed a major asset enhancement in March 2024, achieved the Leadership in Energy and Environmental Design (Leed) Platinum and WELL Gold certification and is the second highest-rated green office building in Italy. SGX RESEARCH

The writer is a research analyst at the Singapore Exchange. For more research and information on Singapore’s Reit sector, visit sgx.com/research-education/sectors for the monthly S-Reits & Property Trusts Chartbook.