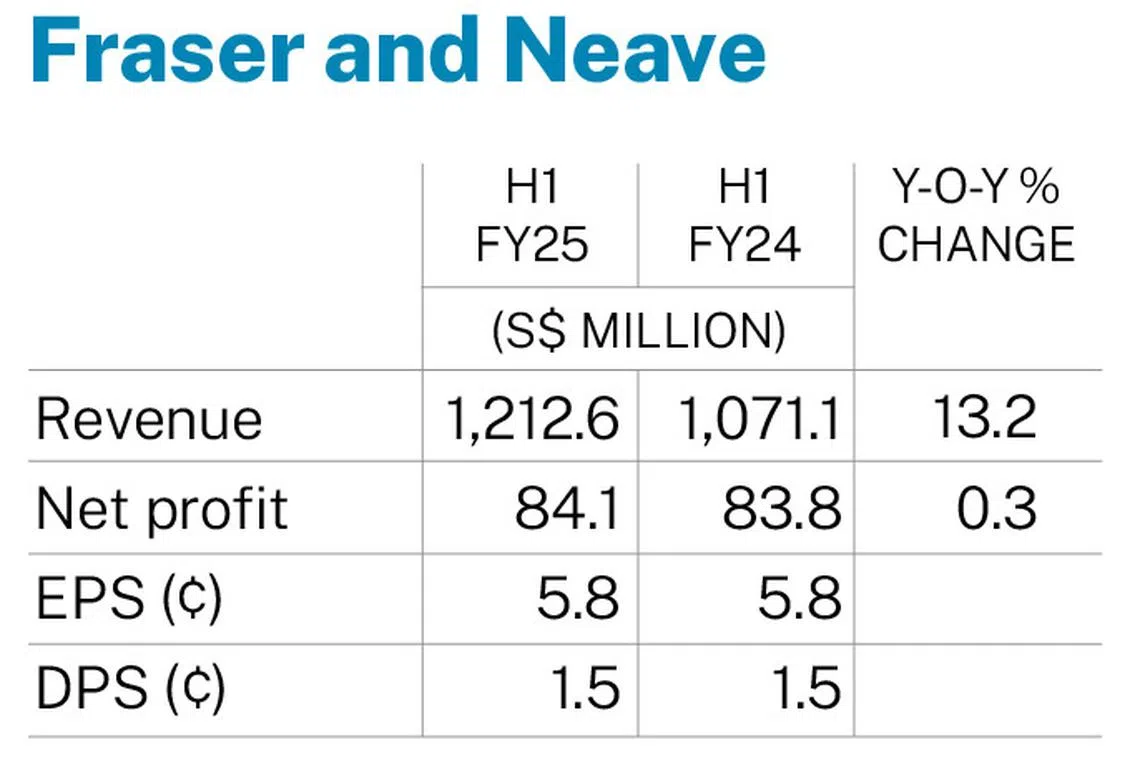

[SINGAPORE] Fraser and Neave (F&N) posted a 0.3 per cent rise in net profit to S$84.1 million for its first half ended Mar 31, from S$83.8 million a year earlier, the food and beverage (F&B) group said on Friday (May 9).

Revenue for H1 rose 13.2 per cent to S$1.21 billion, from S$1.07 billion in the previous corresponding period, driven by strong performance in the F&B division.

The beverages segment, comprising beer and soft drinks, posted a 28 per cent jump in revenue, mainly boosted by strong Chinese New Year campaigns, new products and improved pricing, the group said.

Revenue for the dairies segment increased 8.2 per cent, driven by strong domestic sales in key markets and increased volumes in Laos and Cambodia.

Profit after taxation fell 0.6 per cent to S$124.8 million from S$125.5 million the year before. This was mainly due to a higher effective tax rate following the expiry of a tax incentive, the company said. The group’s effective tax rate rose to 15.8 per cent, up from 15.4 per cent the year before.

Earnings per share for the half year stood at S$0.058, unchanged from the prior year. An interim dividend of S$0.015 per share was declared, unchanged from the year before. The dividend will be paid on Jun 6, after books closure on May 20.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Profit before interest and tax rose 1.6 per cent to S$165.1 million from S$162.5 million, supported by a 5.4 per cent increase in F&B operating profit. However, this was offset by a weaker contribution from the publishing and printing segment, of which profit declined due to the absence of a one-off contribution and higher costs.

Chief executive Hui Choon Kit said that the company’s performance, especially in F&B, has remained resilient in a challenging business environment. “Strong sales, a favourable cost environment, and positive foreign exchange movements in our F&B division reflect our ability to navigate external challenges and capitalise on the strengths of our core business.”

Within the division, Hui noted improvements to the group’s dairy business, which currently contributes the most to overall earnings. In April, the group welcomed 2,500 dairy cattle to its integrated dairy farm, F&N AgriValley, in Gemas, Malaysia.

“This milestone supports our ambition to build a sustainable, vertically integrated fresh milk supply chain in South-east Asia,” he said.

The company will continue to capitalise on its operational resilience to create long-term growth, Hui noted. For instance, the group had invested S$510 million into smart farming and sustainable agriculture, in order to strengthen its growth strategy and commitment to regional food security.

Shares of F&N closed 0.8 per cent or S$0.01 higher at S$1.25 on Friday.