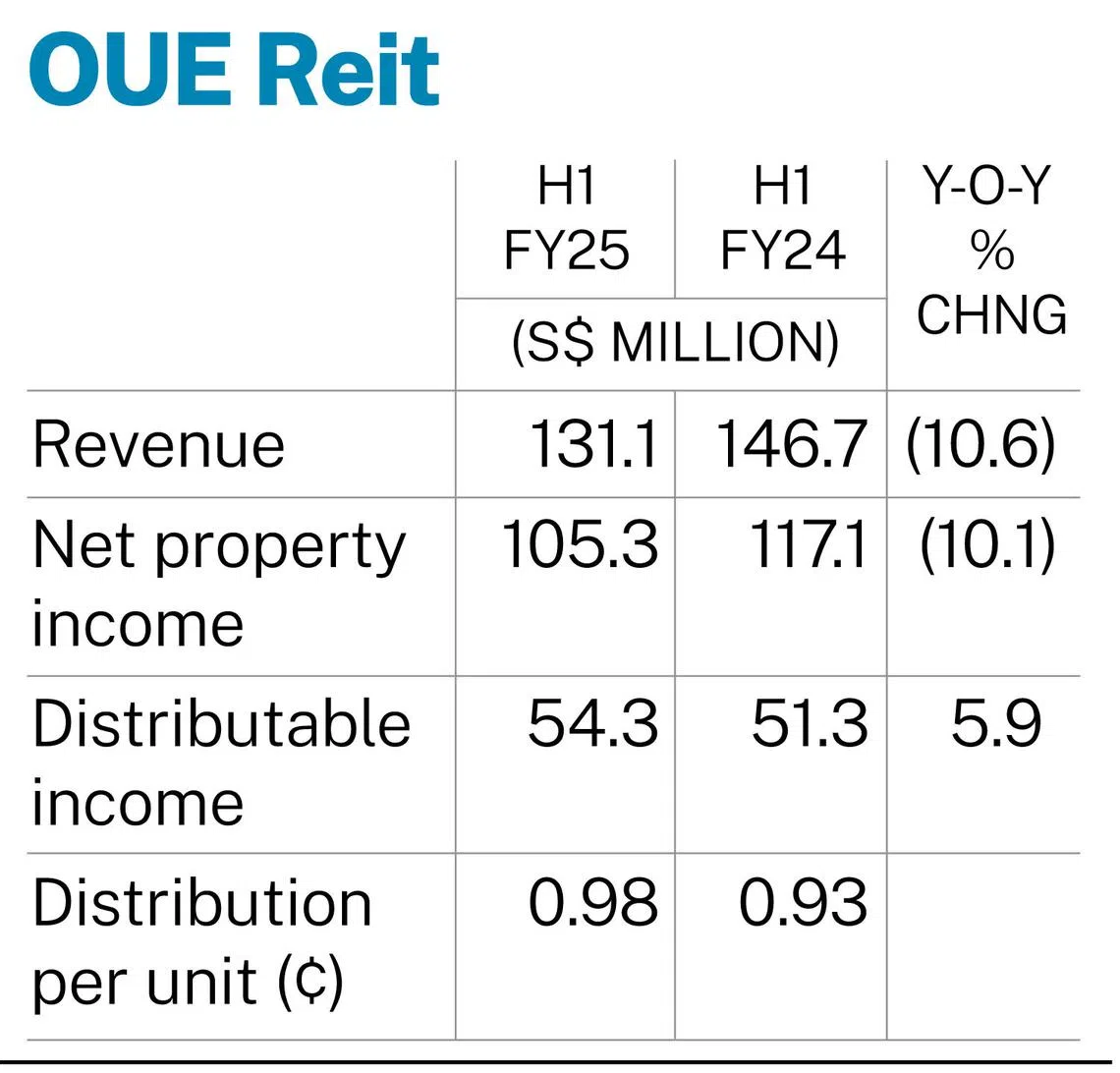

[SINGAPORE] OUE Real Estate Investment Trust (OUE Reit) reported a distribution per unit (DPU) of S$0.0098 for the first half ended Jun 30, 2025, up 5.4 per cent from S$0.0093 in the corresponding year-ago period.

The growth reflects effective capital management and the resilience of its diversified Singapore portfolio, its manager said in a Wednesday (Jul 23) evening bourse filing.

Distributable income, at S$54.3 million, was 5.9 per cent higher than H1 2024’s S$51.3 million.

Excluding the capital distribution in the first half of 2024, core DPU increased 11.4 per cent year on year, it added.

Unitholders will receive the H1 2025 distribution on Sep 3, after the books are closed on Jul 31.

The improved DPU came even as revenue and net property income (NPI) slid.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Revenue in H1 2025 was S$131.1 million, falling 10.6 per cent from S$146.7 million in H1 2024. NPI similarly dropped 10.1 per cent to S$105.3 million, from S$117.1 million.

The manager attributed this mainly to the absence of revenue contributions from Lippo Plaza Shanghai, which was divested in December 2024.

On a like-for-like basis, revenue and NPI fell slightly, by 2.7 per cent and 2 per cent year on year, respectively, with the resilient Singapore commercial portfolio performance partially offsetting lower contributions from the hospitality segment, it noted.

In H1, OUE Reit’s commercial segment grew its revenue 3.6 per cent on year to S$86.1 million, on a like-for-like basis.

NPI, also on a like-for-like basis, grew 5.1 per cent year on year to S$65.2 million.

The Singapore office and retail portfolio achieved a higher average passing rent across all assets, the manager pointed out.

The Reit’s Singapore office portfolio committed occupancy stood at 95.5 per cent as at June 2025. Positive rental reversion remained strong, at 9.1 per cent, for office lease renewals in the second quarter of 2025.

Mandarin Gallery’s committed occupancy remained high, at 99 per cent, and recorded a rental reversion of 34.3 per cent in Q2.

In the hospitality segment, revenue was down 12.9 per cent to S$45 million on a yearly basis. NPI slid 11.7 per cent to S$40.2 million.

The manager attributed the softer performance to a high-base in H1 2024, the result of the start of the China-Singapore visa-free arrangement and the strong calendar of high-profile concerts and Mice (meetings, incentives, conventions and exhibitions) events.

As at Jun 30, 2025, OUE Reit’s aggregate leverage fell by 30 basis points to 40.3 per cent; its weighted average cost of debt remained unchanged from Mar 31, 2025, at 4.2 per cent per annum.

It remains focused on tenant retention and optimising occupancy across its office assets, the manager added.

Units of OUE Reit closed flat at S$0.31 on Wednesday, before the announcement.