CLCR is forecast to have a distribution yield of 4.4% for 2025 and 4.53% for 2026

[SINGAPORE] CapitaLand Commercial C-Reit (CLCR) began trading on the Shanghai Stock Exchange on Monday (Sep 29).

Units of the trust rose 19.6 per cent or 1.122 yuan to 6.84 yuan at market open from its offer price of 5.718 yuan per unit. At the offer price, CLCR’s market capitalisation at listing stood at 2.29 billion yuan (S$409 million).

CLCR’s listing marks the debut of the first retail China real estate investment trust (C-Reit) with an international sponsor. It is also CapitaLand Investment’s (CLI) eighth listed fund.

The new Reit focuses on high-quality, income-producing retail assets in China’s top tier cities.

CLCR, which can be purchased only by Chinese domestic and institutional investors, complements CapitaLand China Trust (CLCT), CLI’s China-focused fund listed on the Singapore Exchange, targeted at international investors looking to invest in China’s retail, business parks and logistics parks.

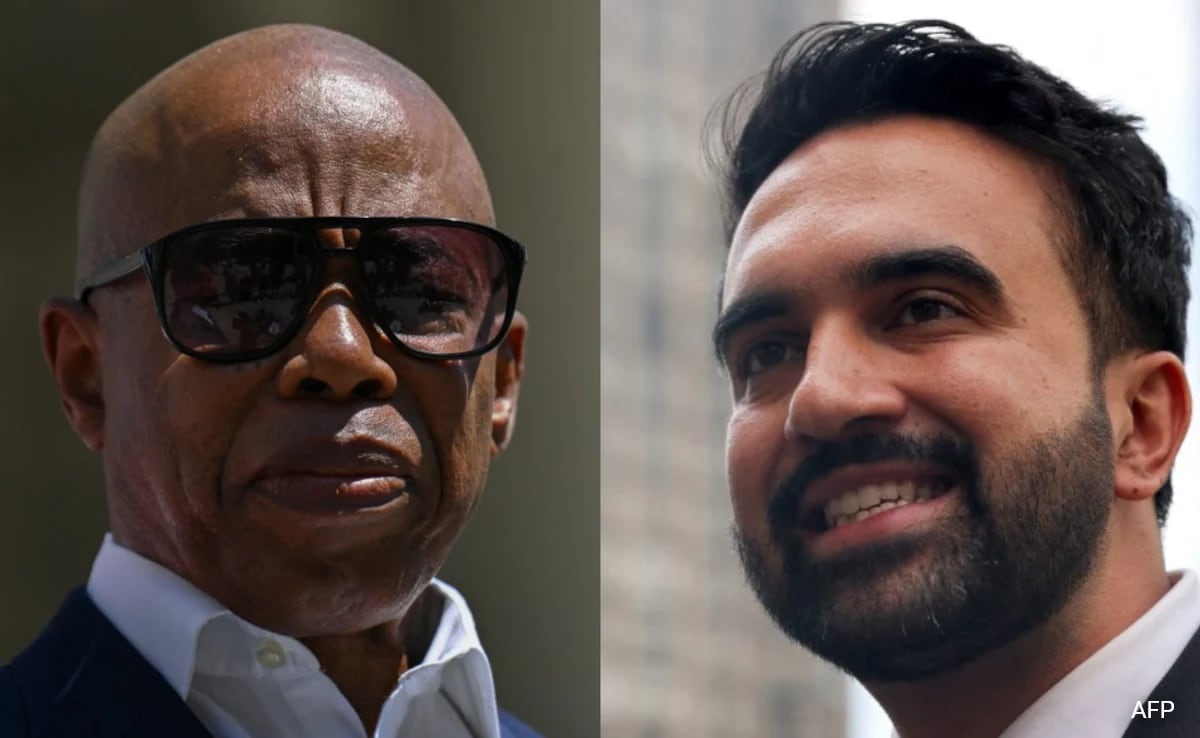

At the listing ceremony on Monday, Puah Tze Shyang, chief executive officer of CLI China, said the C-Reit will provide domestic investors with access to institutional-grade assets amid a low interest rate environment, and also, through a transparent and efficient operating framework, offer opportunities for international participation in China’s public Reits market.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Based on the initial public offering (IPO) price, CLCR is forecast to have a distribution yield of 4.4 per cent for 2025 and 4.53 per cent for 2026.

On the same day, CLI also announced the closure of its first sub-fund under its first onshore master fund in China, CLI RMB Master Fund.

The CLI RMB Master Fund was announced in May with a major domestic insurance company as co-investor. It will invest in a series of sub-funds, with a focus on income-producing assets with long-term growth potential.

The first sub-fund, China Business Park RMB Fund IV, has closed with an equity commitment of 529 million yuan from the master fund. CLI has divested a business park into the sub-fund.

CLI also plans to launch a second sub-fund focused on retail assets in the fourth quarter, with a target equity commitment of 900 million yuan.

Puah said: “By bringing global best practices and over 30 years of experience in China, we are building a high-quality C-Reit platform that delivers long-term value to investors. The listing of CLCR and the continued growth of our RMB Master Fund demonstrate strong momentum in our capital recycling journey and pivot to asset-light business model.”

CLCR’s listing and the group’s renminbi funds also support its domestic-for-domestic fund strategy to tap China’s substantial capital market to grow funds under management and recurring fee income, he added.

Year to date, CLI has recapitalised about five billion yuan of assets in China.

CLI first unveiled its plans to launch its first C-Reit in April.

CLCR’s seed portfolio comprises CapitaMall SKY+ in Guangzhou and CapitaMall Yuhuating in Changsha. CLI and CapitaLand Development (CLD) have divested CapitaMall SKY+ and CLCT is divesting CapitaMall Yuhuating to CLCR for 813.8 million yuan. This is at an exit yield of about 6.2 per cent based on CapitaMall Yuhuating’s actual net property income for 2024 of 50.7 million yuan.

On an overall basis, the malls had an occupancy rate of 96 per cent as at Mar 31.

The public tranche of CLCR’s IPO was 535.2 times subscribed. For its bookbuilding tranche, CLCR achieved a subscription coverage of 254.5 times from offline institutional investors.

CLI, CLCT and CLD collectively hold 20 per cent of the IPO units as joint strategic investors. Cornerstone investors hold 40.11 per cent of units, while offline institutional investors have been allotted 27.92 per cent, and the remaining 11.97 per cent are held by retail and institutional investors who bought units in the public tranche.

Excluding the 20 per cent stake to be held by CLI, CLCT and CLD, the majority of the IPO units were taken up by insurance companies, strategic capital investors and securities firms.

There are currently 75 C-Reits which can be backed by assets from one of five categories. The categories are infrastructure, industrial, rental housing, elderly care facilities and consumption Reits.

C-Reits were launched by the Chinese government in 2021 to diversify funding for infrastructure projects and promote the domestic capital market.

Since 2024, 10 other consumption C-Reits have been listed. These include Reits with shopping malls owned by leading Chinese developers such as China Resources Land, China Vanke and China Jinmao as their underlying assets.

CLI’s ability to add scale and diversity to CLCR’s portfolio to enhance its performance distinguishes the C-Reit from its competitors in the market, Puah said.